-

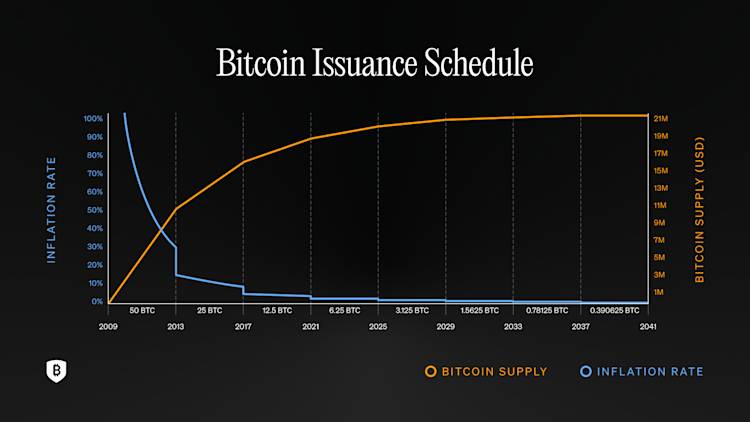

Every 210,000 blocks, the Bitcoin halving reduces future emissions of new coins from the network protocol by half, as it has since inception.

-

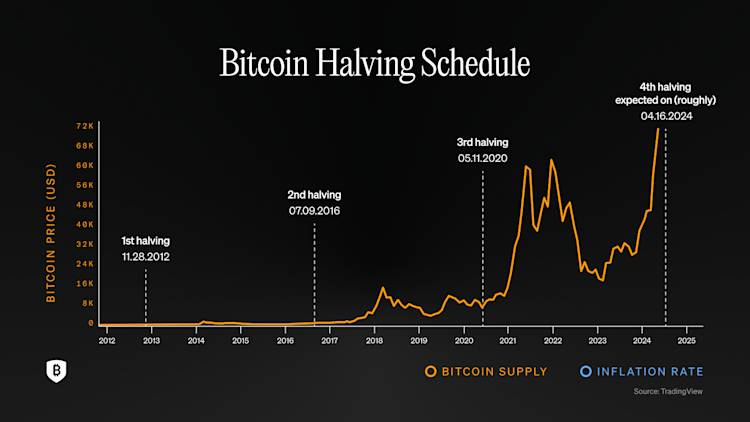

The halving is expected to occur on or around April 19th, 2024. This will lower the amount of Bitcoin per block by half to 3.125.

-

Previous halvings have preceded legendary price appreciation. However, in 2024, Bitcoin hit an all-time high prior to the halving, leaving the industry in exciting but uncharted waters.

Bitcoin Network Basics

Blockchain, the technology powering Bitcoin, is a digital ledger that’s nearly impossible to alter. Instead of one central authority like credit card networks, it relies on a network of computers called ‘nodes.’ These nodes work together to process transactions and keep a complete history of everything that happens on the network. Each node acts like an accountant, checking every transaction to ensure it’s legitimate and follows the rules.

Each node validating transactions is otherwise known as a Bitcoin miner. Miners compete to solve a complex mathematical puzzle to be the validator for the next block. Miners play a dual role. First, they are responsible for collecting transactions, validating, and organizing them inside a block. While collecting transactions, they compete with other miners to find the right hash for the block. If they guess the correct hash, they put all the transactions they validated inside.

How Does The Halving Work?

Mining blocks is the only way Bitcoin is introduced into circulation. The Bitcoin supply is currently at 19.65 million, and the total cap is 21 million. The current block reward is 6.25 bitcoin per block plus the transaction fees inside the block. On April 19, the block reward will drop again to 3.125. The block rewards will continue every 210,000 blocks until the reward is one satoshi (0.00000001 BTC). On the last halving, expected in 2140, Bitcoin block rewards will go from 1 satoshi to zero capping the supply forever. Once the block reward reaches zero, transaction fees are expected to be sufficient to incentivize miners and maintain network security.

As Bitcoin advances into the future, the significance of the halving diminishes in terms of new supply generation, yet it retains psychological importance and marks Bitcoin’s growth periods in epochs. Instead of battling for smaller rewards, miners will battle for the remaining supply and transaction fees.

There are two primary drivers for Bitcoin’s value: Bitcoin is commonly referred to as digital gold, as both gold and Bitcoin have a finite supply. W

hile some may disagree, a finite supply is usually associated with hedging against inflation. Second, Bitcoin and gold are becoming progressively more challenging to mine. As the difficulty rises, this forces miners to innovate efficiently. Because the block reward drops by half, miners must increase their hash power and expend less energy to remain profitable.

Bitcoin’s primary worth lies in its perceived scarcity mechanisms, network effect, and immutable public ledger. Bitcoin’s global accessibility and resistance to censorship also contribute to its value proposition. Unlike fiat currency, Bitcoin’s halving permanently reduces inflation, potentially leading to price appreciation when demand exceeds the supply sold by miners. This forced scarcity is Bitcoin’s main value proposition as a store of value.

Why Does The Halving Matter?

Historically, the halving precedes Bitcoin bull cycles. While “past performance is no guarantee of future results” may be true, the consistent historical pattern observed over the last three halvings is hard to overlook. While sentiment around Bitcoin seesaws, many Bitcoiners and analysts see the halving as a bullish catalyst due to supply constraints.

While many skeptics anticipated the Bitcoin ETF approval to be priced in, others believed this would increase demand as many investors could gain exposure to Bitcoin. The Bitcoin ETF has put us into uncharted waters compared to historical patterns. Bitcoin demand was much higher than anticipated, causing a run-up to a new all-time high.

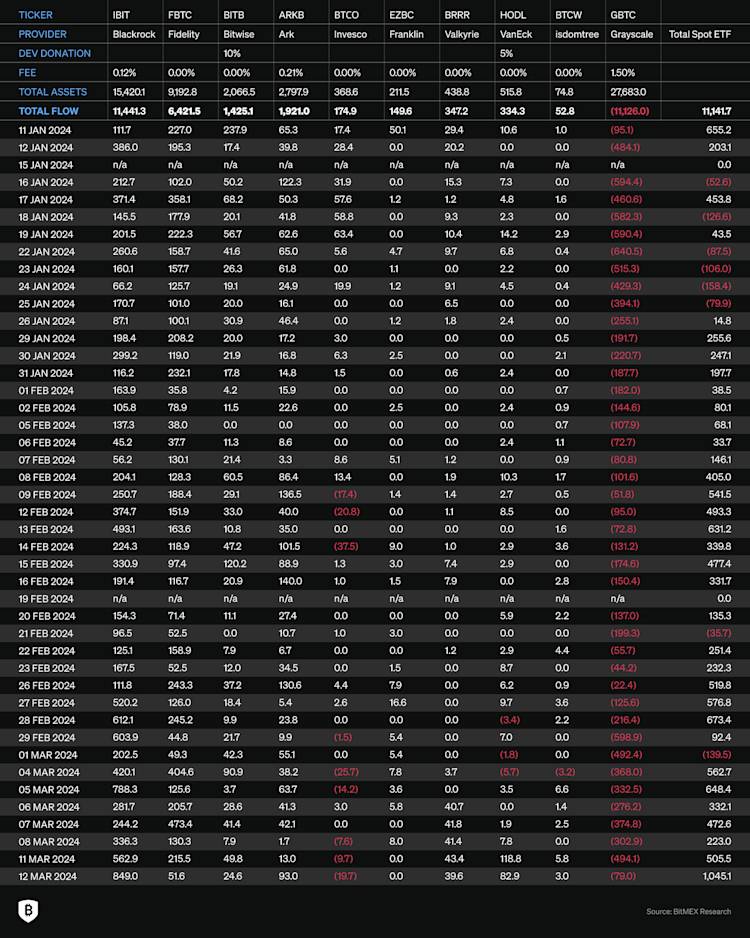

The inflows from the Bitcoin ETF have blown past many analyst predictions. On March 12, Bitcoin ETFs saw a record inflow of over $1 billion (1045 Bitcoin). With the current daily block rewards at 900 Bitcoin, the current inflows exceed the available Bitcoin created daily. Below is a chart of daily Bitcoin ETF inflow. Many expected GBTC to have significant outflows due to higher fees and thought the ETF approval would be a sell-the-news event. However, the inflows into all ETFs have eclipsed any GBTC outflow.

The halving will lower the daily Bitcoin generation to 450 in April. If demand remains consistent, this may cause increasing price action. Regardless of which side of Bitcoin you stand on, like previous halvings, it is a highly anticipated event. This attracts new investors to the market from supply models and historical correlation. This and the widely accessible ETF, could create even further demand.

Looking Ahead

While market predictions remain inherently uncertain, no one can guarantee Bitcoin’s future trajectory. Instead, we focus on historical trends to provide insights into Bitcoin’s cyclical behavior. Time remains a crucial asset for any investor, and Bitcoin’s history offers valuable lessons.

With only 1.35 million bitcoins left to be mined, the approaching Bitcoin halving represents a pivotal moment. This event will further reduce the rate at which new Bitcoins enter circulation, potentially impacting its value. Historically, halvings have sparked increased interest in Bitcoin and blockchain technology. It is an exciting time with many different discussions on how the halving will play out.

Table of Contents

The latest

All NewsAbout BitGo

BitGo is the leading infrastructure provider of digital asset solutions, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have focused on enabling our clients to securely navigate the digital asset space. With a large global presence through multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, as well as millions of retail investors worldwide. As the operational backbone of the digital economy, BitGo handles a significant portion of Bitcoin network transactions and is the largest independent digital asset custodian, and staking provider, in the world. For more information, visit www.bitgo.com.

©2025 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.