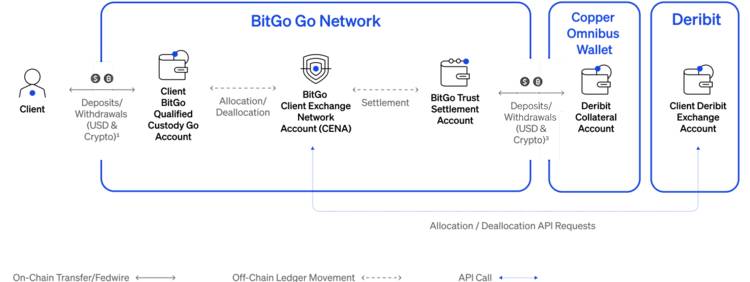

Today, BitGo Trust Company, Inc. and Copper announced the launch of a first-of-its-kind trading and off-exchange settlement solution that brings institutions unparalleled access to liquidity while maintaining the highest level of security for their assets. Clients can now trade on Deribit, the leading derivatives exchange, while their assets are secured off-exchange in qualified custody with BitGo Trust. Trades are then automatically settled via Copper’s ClearLoop and BitGo’s Go Network infrastructure.

Why does this matter?

The multi-custodial settlement model created by BitGo and Copper addresses a critical challenge that investors have historically had to face: accessing deep liquidity without compromising on security or operational agility.

BitGo and Copper have successfully bridged this gap with a solution that seamlessly integrates liquidity, qualified custody, and automated off-exchange settlement for clients. The comprehensive offering marks a significant step forward for the industry and establishes a new standard for trading.

Investors also benefit from increased capital efficiency as they can hold assets with BitGo Trust and trade with partner venues on Go Network freely without having to prefund their strategies on exchange. With the latest addition of Deribit via Copper ClearLoop to Go Network, investors will seamlessly be able to implement sophisticated trading strategies by leveraging Deribit’s robust platform for trading options and futures.

Trading without the trade offs

“Our partnership with Copper represents a fundamental shift in how investors can access exchanges. Holding assets in qualified custody and settling through ClearLoop’s tried and tested settlement process delivers what the market has been asking for—a seamless and secure way to trade. This is a testament to how committed BitGo is to setting a new standard for trading that delivers security and efficiency without compromise,” said Brett Reeves, Head of Go Network.

Ben Lorente, Strategic Alliances Director at Copper commented, "This partnership with BitGo expands our multi-custodial network within our off-exchange settlement network ClearLoop and is a significant step towards our commitment to industry interoperability of secure, reliable, and comprehensive solutions for institutional investors. This continues to ensure long-term institutional adoption of the digital asset ecosystem."

Luuk Strijers, CEO of Deribit adds, “this collaboration marks a significant step forward for the market and investors alike and we’re excited to be at the forefront of it with BitGo and Copper. The synergies between our companies will unlock new opportunities for investors and will completely change the landscape of trading.”

What’s next

As BitGo and Copper continue to push the industry forward, expect to see additional trading venues announced to our qualified custody and off-exchange settlement offering in the not-so-distant future, providing institutions with more secure, expanded access to liquidity.

Learn more about how BitGo and Copper’s partnership is setting new standards and can enhance your trading strategies and operations.

Table of Contents

The latest

All NewsAbout BitGo

BitGo is the leading infrastructure provider of digital asset solutions, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have focused on enabling our clients to securely navigate the digital asset space. With a large global presence through multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, as well as millions of retail investors worldwide. As the operational backbone of the digital economy, BitGo handles a significant portion of Bitcoin network transactions and is the largest independent digital asset custodian, and staking provider, in the world. For more information, visit www.bitgo.com.

©2025 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.