BitGo: Crypto Water Cooler — Aug 14

Stablecoin market shows growing interest in crypto | UK firms get mixed grades for compliance with advertising rules | Who’s betting on Web3 gambling

Stablecoin market shows growing interest in crypto | UK firms get mixed grades for compliance with advertising rules | Who’s betting on Web3 gambling

GM. It’s Wednesday, August 14.

Growing Stablecoin Market Reflects Increased Interest in Crypto

Industry watchers predicted that one of the positive outcomes from U.S. crypto ETFs would be increased interest in digital assets. The growth of the stablecoin market may provide evidence that this is happening. Since stablecoins don’t appreciate in price, the main reason people buy them is to transact between crypto and fiat. That makes their performance a good indicator of market sentiment, and their 2024 performance to date has been strong.

Stablecoin supply has grown for ten consecutive months. Market cap has increased 26.9% in just eight months (about the amount of time BTC ETFs have been in the market) from $130B at the end of 2023 to $165.7B today. Activity has become a leading indicator for the market—though the lead time is admittedly short.

Data analytics firm Lookonchain notes that $1.3B of USDT moved from Tether to centralized exchanges after Bitcoin bottomed out on August 5, an indication that whales might be preparing to buy the dip. The price of Bitcoin went from $50,000 on August 5 to over $62,000 just three days later. Bitcoin fell 4.5% on August 12, two days after the flow of USDT from Tether to centralized exchanges slowed.

USDT is still the leader with a market cap of $115.7B. The company recently made waves by announcing that it had generated $5.2B in profits for the first half of 2024, mainly from its holdings of U.S. treasuries, which currently stand at a staggering $97B—more than Germany and the UAE. But, it will soon have more company.

Ripple predicts the market could grow to $2T by 2028 and is currently testing its own stablecoin. It would join a crowded market that includes Tether, Circle’s USDC (which has a $34.4B market cap), decentralized options like MakerDAO’s DAI and Ethena’s USDe, and options from TradFi providers like State Street and PayPal whose PYUSD has seen it market cap has more than triple from just over $200MM in late April to over $700MM today.

While the industry is thriving, there are still hurdles to navigate. MiCA regulations around licensing and reserves went into effect at the end of June, causing some centralized exchanges to delist USDT and other stablecoins in the EU. And, while issuers like Tether and Circle release attestations to their holdings, many would like to see them provide fully-audited reserves.

Read more: CoinDesk

FCA Report Gives Firms Mixed Grades for Compliance With Ad Rules

In June of 2023, the UK’s Financial Conduct Authority (FCA) set rules for advertising cryptocurrencies to retail investors—the country’s first pass at regulating the industry. Last week, the FCA published a six point report card of sorts to assess how firms are complying with the rules and to benchmark best practices and areas for improvement. In general, it found that, despite having worked closely with firms and delayed the implementation deadline from October 2023 to January 2024, compliance is still a work in progress.

The FCA sampled the onboarding process for firms who are either registered under its money laundering rules or can approve promotions for unregistered/unauthorized firms. It reviewed practices, including for the cooling-off period, personalized risk warning, client categorization, appropriateness, record keeping, and due diligence.

All firms got a good grade for providing the mandatory twenty-four-hour cooling-off period before investing—but many didn’t offer consumers an express choice to not follow through with the investment. Personalized risk warnings were an area for improvement, needing to be placed more prominently and at the beginning of the journey.

Firms must sell assets only to consumers who can ensure that they meet criteria showing they can absorb potential losses, and most are providing assessment tools for that purpose. However, some firms were found to be helping people answer questions and/or not checking the answers closely enough to qualify people. Companies must also assess whether the person has the knowledge to understand the risks. Poor practices include using this process as an educational one and guiding consumers towards the correct responses.

Most firms would get an A for capturing consumer information during the process but didn’t do as well verifying and knowing how to use this data. Foundational due diligence was also an area of success.

Read more →FCA

Web3 Betting Industry Booms

Web3 gambling is becoming a big business, with customers wagering nearly $79B in crypto over the past four years, according to a Chainalysis report. Besides being able to bet with crypto, the big draw is greater transparency and less reliance on intermediaries, resulting in lower fees and reduced third party risk.

For example, instead of placing funds with the house or a bookie, you can confirm the bet through your crypto wallet and keep your funds in your wallet until the outcome is resolved. Winnings (or losings) are then transferred instantly. Some, but not all Web3 gambling sites, use smart contracts to make both game logic and transactions auditable. Some give participants tokens that serve as ownership shares.

Polymarket, which enables betting on political events and raised $70MM earlier this year, is perhaps the best known platform, passing $1B in volume on increased speculation over who will win the U.S. presidential election. Betting on elections is illegal in the U.S., and the platform has had to geofence the region after being fined by the CFTC, which is seeking to regulate prediction markets.

Sports betting is a big category; the market is worth almost $60B and is expected to grow at a rate of more than 10% annually, according to Zion Market Research. In that category, DuelNow ($11MM), Wincast ($3.4MM), Shuffle ($2.5MM), and Maincard.io ($2MM) have all raised modest rounds this year.

Although they face the same challenges around user experience as Web3 gaming overall, gambling businesses can glean plenty of insights about player activities, holdings, and habits that offer the opportunity to increase engagement by customizing strategies to player activities.

Players break down into two segments, according to Chainalysis. Crypto whales—who, over the past year, have sent $320MM to Web3 casinos with average individual transfer sizes of $25,000—and high frequency players that have sent $100,000+ apiece, about $7,000 at a time, to Web3 gambling sites for a total of $5B. Personal wallet use dominates for deposits (61%) and withdrawals (70%) with exchange wallets making up the difference.

Besides regulatory risks, gambling sites could also become a vector for money laundering. And, giving people faster, easier ways to lose money could also prove problematic. To wit: it was recently reported that the founder of a Canadian exchange stole $9.5MM from exchange customers and gambled it away in crypto casinos.

Read more →Chainalysis

Business of Crypto

More Money, Fewer Deals: Q2 VC Funding Recap - Bloomberg ($)

Bitcoin Miner Reserves Drop to Lowest Levels in 3 Years - CryptoGlobe

Singapore’s DBS Bank Launches Ethereum-based Treasury Solution - Cointelegraph

Regulation and Security

Ripple Ordered to Pay $125MM, a Fraction of Penalty SEC Sought - Bloomberg ($)

BitGo Obtains Major Payment Institution License in Singapore - Cointelegraph

U.S. Fed Takes Action Against Web3-Friendly Customers Bancorp - PYMNTS

DeFi and Web3

Polymarket, AI Search Engine Perplexity Strike Data Sharing Deal - The Block

Hamster Kombat Eschews VC Money, Plans to Reserve 60% of Tokens for Players - Cointelegraph

Sony Bank Launches App for Trading NFTs on Its Marketplace - CoinGeek

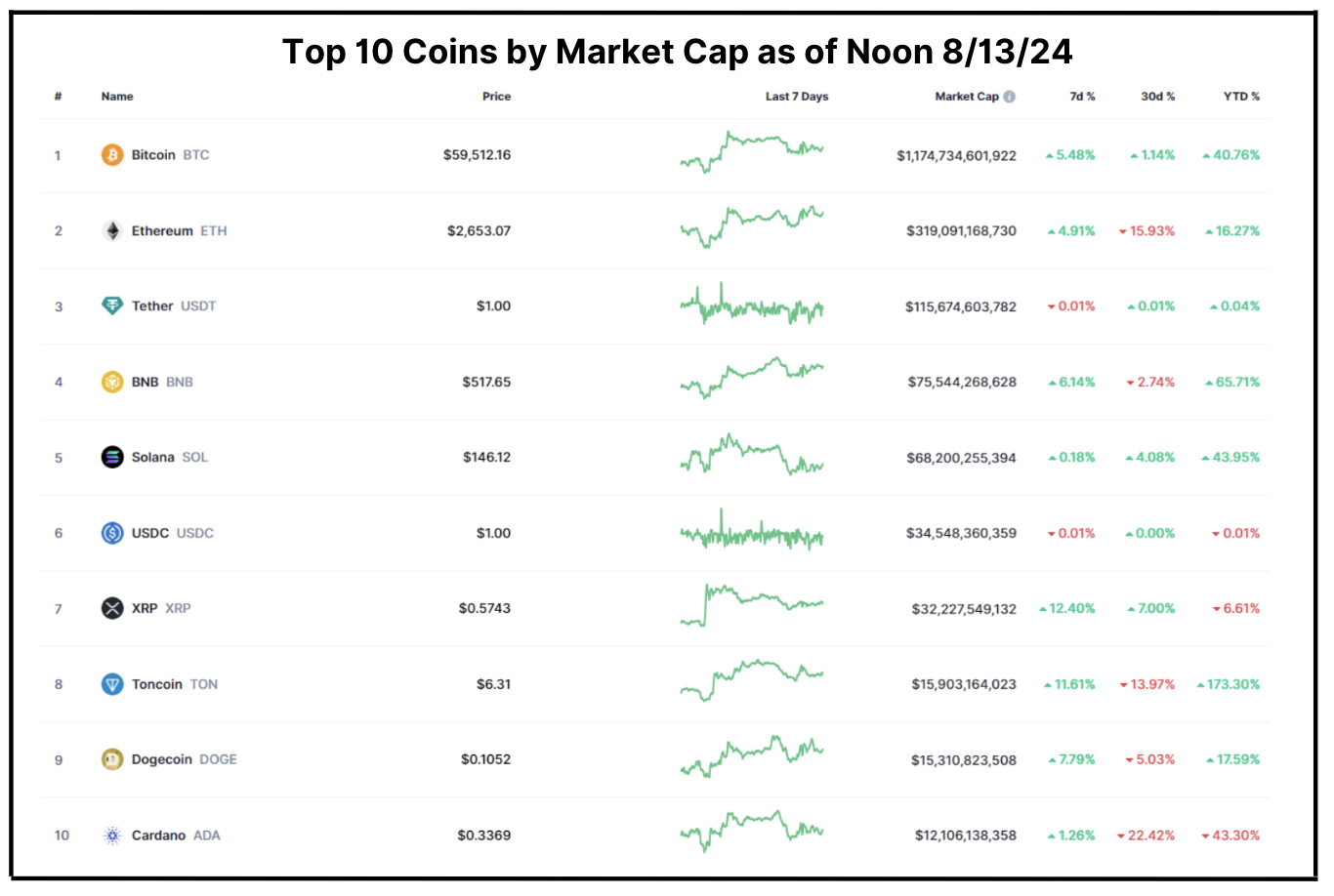

Total Market Cap: $2.1T – 7-day change as of Tuesday 8/13/24 12 PM EST: +5.0%

In a week marked by volatility, the crypto market rebounded from last week’s tumble, climbing 5% to $2.1T.

After sinking to $50K August 5, Bitcoin (BTC, +5.5%) surpassed $62K last Thursday before retreating to just below $60K. Investors may be feeling cautious about the macro environment; JPMorgan Chase now predicts a 35% chance of a recession in 2024. On the other hand, U.S. Producer Price Index data released Tuesday showed increases smaller than expected ($). The release of Consumer Price Index data on Wednesday will shed further light on the state of the U.S. economy and the consumer.

Ethereum (ETH, +4.9%) briefly retook the $2,700 level but has since slid slightly lower. Last week, ETH ETFs saw their first week of positive inflows, taking in a net of $105MM. BlackRock’s iShares Ethereum Trust is closing in on $1B in inflows while Grayscale’s ETHE appears to be stabilizing following fourteen straight days of net outflows. ETHE has endured nearly $2.3B worth of outflows since the new Ethereum ETFs launched.

In a surprising reversal of recent trends, DEX trading volumes also increased by double digits on Ethereum over the past week while Solana’s (SOL, +0.2%) activity decreased by 10%.

Sui (SUI, +58.0%) hit the top 30 cryptos by market cap as it added over $1B in market cap since its August 5 low on two catalysts: an endorsement on X from Real Vision CEO and co-founder Raoul Pal to his 1MM followers and Grayscale’s announcement it will launch a new Grayscale Sui Trust. AI-focused project Bittensor (TAO, +6.1%) will also be getting its own Grayscale Trust as will MakerDAO (MKR, +13.4%)

Investment Trust

: A closed-end fund that can only be traded once per day—at the end of the trading day.

/ Unlike an investment trust, an ETF is open-ended and can be traded at any time during the trading day.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.