BitGo: Crypto Water Cooler — Aug 7

Olympics Esports 2025 ripe with opportunity for DeFi | DEXs gain ground on centralized exchanges | Beyond Bitcoin: Sei’s explosive growth

Olympics Esports 2025 ripe with opportunity for DeFi | DEXs gain ground on centralized exchanges | Beyond Bitcoin: Sei’s explosive growth

Olympic Esports 2025 Could Be a DeFi Bonanza

Sports fans feeling anxious about the void of emptiness following the end of the Olympics on Sunday, fear not. The first-ever Olympic Esports Games are coming in 2025. In July, three days before the 2024 Games began, the International Olympic Committee (IOC) announced a twelve-year partnership with the National Olympic Committee of Saudi Arabia to kickstart Olympic Esports.

Saudi Arabia, which previously hosted the inaugural Esports World Cup, will host the inaugural games. The venue is yet to be determined as are the sports that will be played or how players will qualify, but the games are likely to find a receptive audience. The IOC estimates that there are over 500MM esports players worldwide, most under the age of thirty-five. Given those demographics, the IOC began studying esports in 2018 and, in 2023, hosted a successful esports week in Singapore featuring virtual competitions in ten sports.

This is not the IOC’s only digital play. This summer, it licensed Olympics Go! Paris 2024, a game in which players build virtual cities to unlock access to a dozen Olympic sports, including the new breaking competition.

DecentraBlock sees many ways in which the Olympics might further leverage Web3 technologies. Fan plays could include NFTs of iconic Olympic moments, official Olympic merchandise authenticated via token, and tokenized voting for favorite athletes or music selections. Rewards for engagement could include virtual event attendance, access to forum discussions, and fan club membership.

Web3 technology could also help with operations, ensuring transparency and fairness of judging and scoring—particularly in more subjectively ranked sports. Athlete data could be stored on blockchains. Smart contracts could automate scoring to help eliminate human error or bias. Tokenized sponsorships would allow smaller investors to participate.

Read more →Fortune($)

Why Centralized Crypto Platforms Are Slowly Losing Ground to DEXs

According to an analysis by Decrypt, centralized exchange (CEX) platforms have lost market share to decentralized exchanges (DEXs) over the last six months. DEX trading volume in January was $133.5B and, as of February, trading on DEXs accounted for 4.6% of total trading volume. In July, DEX trading volume hit $179.5B, an increase of ~34%, and the DEX share of total trading volume hit 7%+—an increase of 52%.

Key drivers include the explosion of long-tail assets and the growth of liquid staking.

It’s become trivially cheap and easy to launch meme coins on platforms like pump.fun. These and other long-tail assets are generally listed first on DEXs where there are few barriers to entry. If they have staying power, they eventually make their way to CEXs, which offer more credibility and liquidity but also have stricter vetting processes and higher fees. As of 2023, CEX listing fees ranged from $6,000-$30,000 for a small exchange; $60,000-$300,000 for medium ones; and a whopping $1MM to $2.5MM for the largest, most reputable exchanges. Listing on a DEX is essentially free.

DEXs are also a better fit than CEXs for liquid restaking tokens (LRT), which have seen 8,300% growth in TVL: from $164MM to $13.8B in 2024. Although it’s possible to use LRTs on CEXs, it comes with challenges, including a lack of transparency because CEXs process transactions off-chain.

To be sure, DEXs won’t soon overtake CEXs. But what could happen, according to Messari Senior Research Analyst Kunal Goel, is that CEXs will become DEXs. He cites CEX giants Coinbase and Binance, which have already launched DEXs: Base and BNB Chain, respectively. However, these appear to be additional offerings, not replacements for their far larger CEX businesses.

Read more →Decrypt

Beyond Bitcoin: Sei Upgrade Turbocharges Growth

The push to build a better blockchain has created a large, fiercely competitive playing field of low-cost, high-performance blockchains. To achieve staying power, the challenge now is to bolster performance metrics with the network effects that come with a passionate community. One notable example of an emergent blockchain looking to thread this needle is Sei, a fast-growing trading-focused Layer 1 built on the Cosmos SDK.

While Sei’s $7785MM market cap puts it at #70 on the list of all cryptocurrencies, it’s growing remarkably fast for a network that only went live a year ago, propelled in large part by its May upgrade to Sei V2, which made it the first parallelized, EVM-compatible blockchain to go live. Since the upgrade, TVL has more than doubled to over $60MM, and weekly active users have grown from 10.5K to 63K.

Sei touts transaction time to finality of 390 milliseconds and throughput of 45 transactions per second, which it has achieved without any outages. However, milliseconds more speed may not matter to the average crypto user, and Sei has also invested in building a passionate community of “Seiyans” on X (a clever nod to “Saiyans,” a race of alien warriors from the popular Japanese anime and manga Dragon Ball Z).

Sei’s team members have experience at mega-cap tech firms and financial services firms ranging from Goldman Sachs to Robinhood. It has considerable venture backing, giving it a large war chest for grants to attract developers. That and the upgrade have helped it to attract a plethora of projects, including games, NFT marketplaces, a meme coin launch pad, borrowing and lending protocol Yei Finance, and Dragon Swap, the top decentralized exchange on Sei. Sei also launched a $50MM Japan Ecosystem Fund in July.

Read more →Forbes Advisor

Business of Crypto

Stablecoin Market Growth Soars as Crypto Enters the Mainstream - Cointelegraph

Staking Platform Kiln Launches Platform to Simplify Stablecoin Rewards - The Block

Hong Kong’s Largest Broker Introduces BTC, ETH Retail Trading - CoinGape

Regulation and Security

El Salvador Proposes Crypto for Trade With Russia - crypto.news

South Korea to Levy Supervisory Fees on Regulated Exchanges - CoinPedia

French Regulator Begins Accepting Service Provider Applications Ahead of MiCA - Bitcoin.com News

DeFi and Web3

DePIn Renewable Energy Project Daylight Raises $9MM Led by a16z - The Block

Grayscale Launches New DeFi/AI Fund - The Cryptonomist

DeFi Lending Recovers to 2022 Levels - Cointelegraph

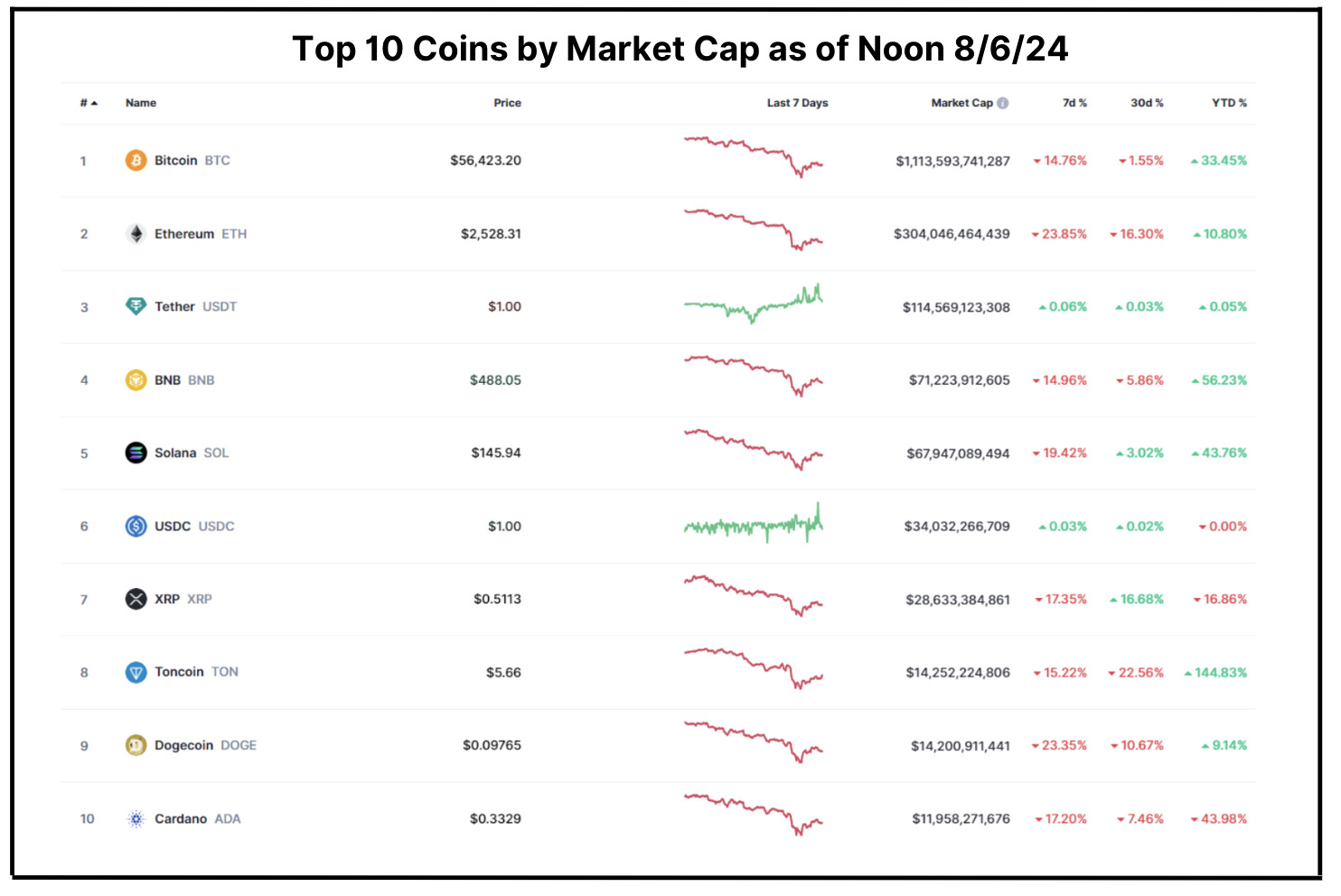

Total Market Cap: $2T – 7-day change as of Tuesday 8/6/24 12 PM EST: -16.0%

Chart and quotes via CoinMarketCap

The crypto market fell sharply this week, declining 16.0% to $2T, based on a confluence of global macro factors that also hit TradFi markets hard. The unwinding of the yen carry trade caused Japan’s Nikkei index to have its worst day since 1987’s Black Monday. Plus, the release of poor jobs data in the U.S. on Friday, escalating hostilities between Israel and Iran, fears about the yield curve inverting, and concerns that the Fed should have lowered interest rates sooner conspired to reignite recession fears.

Over a 24-hour period from Sunday into Monday, $1.19B worth of crypto futures positions were liquidated, according to data from Coinglass. A staggering $424.1MM worth of Bitcoin (BTC, -14.8%) positions were liquidated, briefly sending BTC below $50K for the first time since February. Whales bought the dip as large wallets holding between 1K and 10K BTC added to their holdings.

Ethereum (ETH, -23.9%) suffered $375MM in liquidations, at one point losing all of its 2024 gains. ETH faced additional pressure as Jump Crypto unstaked $315MM worth of ETH and moved it to exchanges, presumably to sell, in a move that was heavily criticized by some and that Investor Business Daily characterized as the firm betting on a decline after ETFs were approved. The firm still owns about $110MM worth of staked ETH.

Solana (SOL, -19.4%) and other major altcoins like BNB (BNB, -15.0%), Toncoin (TON, -15.2%), and Avalanche (AVAX, -21.3%) all endured steep weekly declines as well.

While the selloff was certainly painful in the short term, markets were beginning to bounce back on Tuesday morning after the Nikkei notched a record gain to close the day up 10.2%. Cboe’s Volatility Index, (commonly known as the VIX), hit its highest levels since 2020 with an explosive jump from 23 on Friday to 65 on Monday morning, reflecting the global roller coaster ride.

The macro malaise did nothing to slow the meme coin juggernaut. Coin makers kicked into full gear to churn out Olympic air pistol shooting-themed coins inspired by both South Korea’s Kim Ye-Ji and Turkey’s Yusuf Dikec immediately after they shot to overnight fame—Ye-Ji for her futuristic warrior look and “main character energy” and Dikec for his decidedly more laid-back approach as much as for their medal winning performances.

Long-Tail Asset

noun

: Cryptocurrencies that are less popular and have low trading volumes

/ Statistically speaking, a larger share of a commodity or population is likely to reside in the long tail.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.