BitGo: Crypto Water Cooler — July 31

ETH ETFs debuted to strong interest | States, CFTC renew challenges to SEC authority | Russia may use crypto to evade sanctions

ETH ETFs debuted to strong interest | States, CFTC renew challenges to SEC authority | Russia may use crypto to evade sanctions

GM. It’s Wednesday, July 31.

Strong Interest, Muted Price Action: Takeaways From ETH ETF Debut

Ethereum ETFs are here, and speculation about their reception can now give way to data. On day one, ETH ETFs collectively generated over $1B in trading volume, an impressive debut but only about 23% of their Bitcoin counterparts’ record-setting launch day. Net inflows totaled $106.6MM after accounting for $484.1MM of outflows from the Grayscale Ethereum Trust (ETHE). As of July 29, $1.7B in outflows from ETHE have offset $1.3B of inflows into the new ETFs for a net outflow of $440MM.

Grayscale amassed nearly $10B in assets under management in ETHE, which had been trading over the counter since 2019. In converting ETHE to an ETF, it did not reduce its 2.5% fee even though its new competitors have expense ratios of 0.25% or lower. However, it created the Grayscale Ethereum Mini-Trust (ETH), which it seeded with 10% of ETHE’s assets and has fees of .15%. The strategy of bracketing the high and low end is the same one it followed when it converted its Grayscale Bitcoin Trust (GBTC) to an ETF—an event that triggered nearly $20B in outflows from the legacy fund in the first four months of trading as investors shifted to lower-cost options.

With ETHE, other factors are also at play. Yield from staking is now part of Ethereum’s appeal to many investors, but many ETHE holders bought while Ethereum was a proof of work blockchain. Whereas the bulk of GBTC outflows went right into other BTC ETFs, ETHE sellers may not take the same path, opting instead to hold Ether directly to benefit from staking. And, as James Hunt points out in The Block, GBTC was still trading at a discount to Bitcoin when the ETFs launched. That gap had already closed for ETHE, creating a greater incentive to sell it.

Analysts believe continued outflows from ETHE could put downward price pressure on ETH for several weeks. Still, the level of interest is encouraging, given that Ethereum is more of a crypto infrastructure play than a pure price play. On the downside, increased interest may also bring more regulatory scrutiny to the many applications that exist on the Ethereum network, Sean Stein Smith writes in Forbes.

The ETF market is notoriously competitive and often a winner-takes-all game—hundreds of ETFs closed in 2023. Whether there is enough demand for nine ETFs holding non-stakeable ETH remains an open question.

Read more →CNBC

States, CFTC Renew Challenges to SEC Authority Amid Market Boom

Crypto is enjoying a renaissance in U.S. markets and politics. What better time to renew efforts to find a more hospitable regulator than the SEC?

A seven-state coalition led by Iowa Attorney General Brenna Bird filed an amicus brief on July 10 opposing the SEC's efforts to regulate the industry, arguing that crypto is not an investment contract under the Securities Act of 1934. Arkansas, Indiana, Kansas, Montana, Nebraska, and Oklahoma joined the brief.

Also on July 10, Rostin Behnam, chair of the U.S. Commodity Futures Trading Commission (CFTC), testified before the Senate Agriculture Committee, saying that the CFTC is prepared to oversee spot crypto trading with strong investor protections, AML protocols, and educational programs. Senator Debbie Stabenow (D-MI) plans to outline a framework granting the CFTC this authority; currently, the CFTC only has the authority to address problems after the fact. More than half of the agency’s fiscal year enforcement actions involve alleged crypto fraud.

“Prepared” appears to be a mental rather than operational state. The CFTC’s budget and staffing are about one-sixth of the SEC’s. Behnam estimated the agency would need $30-35MM in year one and $50-60MM in year two to hire one hundred people, upgrade technology, and administer regulations. Acknowledging the lack of clarity over crypto’s status as a commodity or security, Benham recommended legislation ironing out how the CFTC and SEC would jointly oversee crypto.

But more budget and staff may not be enough preparation. In an OpEd in The Hill, Senior Director for Financial Regulation Policy at the Center for American Progress Alex Thornton points out that consumer protections and ensuring fair markets are outside the CFTC’s historical area of scope and expertise. The agency’s remit is to regulate derivatives, which are only traded on the Chicago Mercantile Exchange, and typically only by hedge funds. The CFTC has nothing analogous to the SEC’s rules for sales and marketing, allowable fees, and consumer disclosures that must be made by the sellers of securities and the many venues that host trading.

Read more →The Hill

Russia's Crypto Evolution: From Total Ban to International Payments

Russia, home to the world’s eleventh-largest economy, is the latest nation to look to digital currencies to solve monetary problems. In a draft bill, the State Duma approved experimenting with international crypto payments to circumvent war-related sanctions. Federation Council senators are expected to quickly approve the draft bill.

Russia’s imports dropped 8% in Q2 2024, and cross-border payments that used to take one to two days are now taking up to three months. Only a “dwindling pool” of Chinese banks are willing to defy sanctions and face retribution. India and the United Arab Emirates are also being more cautious. Chinese-owned digital platform Qifa, though, is facilitating USDT stablecoin payments between China and Russia.

The move is a reversal of trajectory; just before its full-scale invasion of Ukraine in 2022, Russia’s central bank had proposed a total ban on cryptocurrencies.

Crypto analyst Ani Aslanyan told Bloomberg that the U.S. will likely monitor Russia's channels to block payments that violate sanctions. She also notes that only a “closed club” of large exporters who mine their own crypto will likely meet regulatory requirements.

If signed into law by President Vladimir Putin, the Bank of Russia could begin to establish requirements as early as September 1, with transactions taking place before the end of 2024.

Read more →Bloomberg ($)

Business of Crypto

Bank-Backed Blockchain Clearing and Settlement Startup Partior Raises $60MM - FinTech Futures

Cantor Fitzgerald to Launch $2B Bitcoin Financing Arm - The Block

Slovenia Issues €30MM Digital Bond, Europe’s First, on BNP Paribas Blockchain - Ledger Insights

Regulation and Security

U.S. SEC Drops Request for Court to Decide if Tokens in Binance Suit Are Securities - CoinTelegraph

UK’s FCA Fines Coinbase $4.5MM for Serving High-Risk Customers - PYMNTS

DraftKings Exits NFT Business Amid Class Action Suit Charging They Are Securities - CoinDesk

DeFi and Web3

Web3 Startups Raised $2B in Q2 - Crunchbase

DEX Market Share Reaches All-Time High; Centralized Exchange Volume Slips - CryptoSlate

Former Base Team Members Raise $21MM for Gaming Infrastructure -

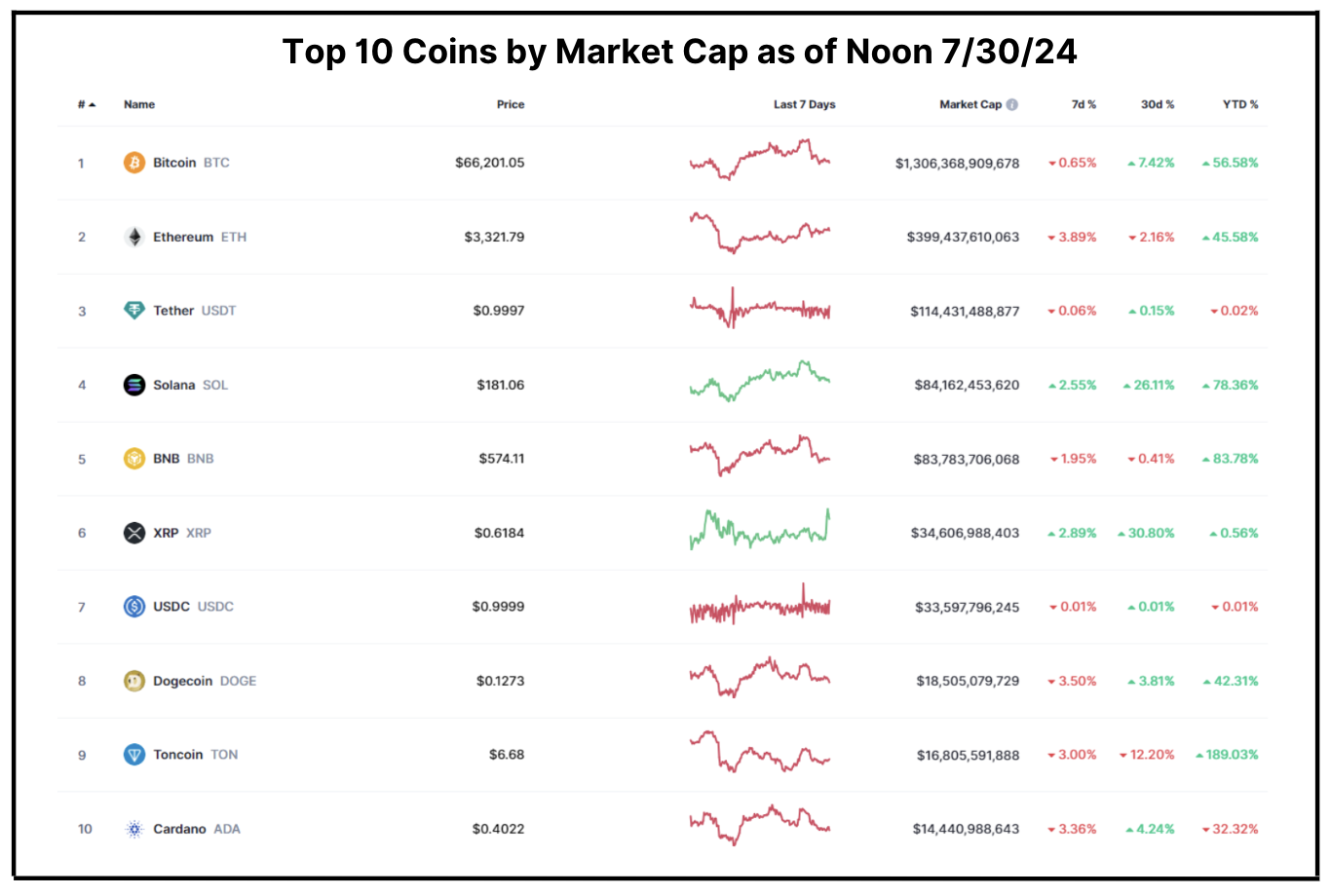

Total Market Cap: $2.38T – 7-day change as of Tuesday 7/30/24 12 PM EST: -1.2%

After plenty of sound and fury, much of it coming from the Bitcoin 2024 conference in Nashville, where speakers included presidential candidates Donald Trump and Robert F. Kennedy Jr., the global crypto market cap landed close to last week’s level, down 1.2% to $2.38T. Bitcoin (BTC, -0.7%) spiked leading into the conference but later fell back.

Trump and Kennedy shared plans to usher in a more friendly regulatory regime, give more favorable treatment to miners, and keep crypto businesses in the U.S. Kennedy and Senator Cynthia Lummis (R-WY) each announced plans for the U.S. to stockpile crypto as a strategic reserve; both would have the government buy large amounts of BTC. Trump did not call for a strategic reserve; his policy would be to HODL Bitcoin the government already holds, which it obtained via asset seizures.

Meanwhile, a wallet associated with the U.S. Dept. of Justice moved $2B in BTC seized from Silk Road to an unidentified wallet on Monday, signaling that governmental selling pressure that loomed over the market earlier this month could return.

Elsewhere, the launch of Ethereum (ETH, -3.9%) ETFs wasn’t enough to push the number two digital asset into the green against outflows of $1.9B from the Grayscale Ethereum Trust. Solana (SOL, +2.6%) continued to perform well. TVL has swelled to $5.4B, up from about $4.5B at the start of July driven in part by liquid staking protocols Jito and Marinade, which have seen their TVL increase 33.0% and 23.6%, respectively, over the past 30 days.

Liquid Staking

noun

: A service that gives digital asset holders utility from staked assets

/ In liquid staking, stakers receive a token they may use on other protocols for a variety of purposes, including restaking.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.