BitGo: Crypto Water Cooler — July 10

Mt. Gox BTC repayments roil market | New U.S. tax rules shift burden to brokers | Why 240MM people are playing Hamster Kombat

Mt. Gox BTC repayments roil market | New U.S. tax rules shift burden to brokers | Why 240MM people are playing Hamster Kombat

GM. It’s Wednesday, July 10.

After a decade of turmoil, bankrupt Japanese crypto exchange Mt. Gox is set to make the first tranche of payments to customers — roiling the market and helping send BTC to its biggest weekly fall in nearly a year.

Mt. Gox, founded in 2010, was crypto’s first centralized exchange, coming to handle 70% of all BTC transactions. In 2014, 750,000 of the 850,000 BTC it held (100,000 of its own and 650,000 belonging to its customers) was stolen in a now legendary hack. At the time, the theft accounted for 7% of all circulating BTC and was valued at $473MM. The exchange declared bankruptcy, leaving creditors — including 127,000 customers — owed $414MM.

Its explanations were vague, and the event fostered distrust in centralized exchanges. The Japanese government responded by creating the world’s first comprehensive crypto regulations, which kept Japanese investors safe when FTX crashed.

To add to the mystery, in 2014, shortly after the bankruptcy filing, Mt. Gox said it found 200,000 BTC in a “forgotten” wallet. Although many questioned that story, the discovery gave them the means to pay creditors through bankruptcy court proceedings, typically a two year process in Japan. However, the novelty of crypto complicated matters and, after three years, the case was transferred to a more flexible civil rehabilitation process.

Claimants needed to refile, and the civil court had to verify their claims. Finally, in 2021, customers could agree to an early payout of a BTC-Bitcoin Cash combo.In June 2023, Tokyo courts approved the plan, with payouts due by October 31, 2024. Also in June 2023, two Russians were charged with attempting to launder 647,000 BTC allegedly stolen from Mt. Gox. In July 2024, Mt. Gox has started to move 47,228 BTC ($2.71B) of recovered assets to approved entities: Kraken, Bitstamp, BitGo, SBI VC Trade, and Bitbank, in preparation for distributions.

Customers will receive about 15% of the BTC they held. However, in the intervening decade, its value has increased about one hundred fold, so some may be eager to sell and claim their share of the ~$9B that will be returned.

Read more →Market Watch

Up until now, U.S. crypto traders have had to report their own tax information to the IRS. That’s led to a multi-billion dollar tax gap due to confusion over requirements, challenges gathering information, and plain old tax evasion. That’s about to change with new rules that shift the burden of reporting trading activities from investors to the brokers.

After receiving 44,000 public comments, the U.S. Department of the Treasury and the IRS released the final version of the new rules. Brokers — defined as custodial digital asset trading platforms; some hosted wallet providers; digital asset kiosks; and certain digital asset payment processors — must annually furnish investors and the IRS with a 1099-DA (Digital Asset Proceeds from Broker Transactions form), similar to the 1099-B used for equities tax reporting.

Mandatory reporting begins in 2026 for the 2025 tax year. As with the 1099-B, brokers must report the original price/cost basis, sales prices, and the resulting gain (if over $600) or loss. DeFi platforms and non-hosted wallet providers will initially be exempt from these regulations with separate rules being created for them, effective 2026.

Per IRS Commissioner Danny Werfel these regulations are an “important part of the larger effort on high-income individual tax compliance… to make sure digital assets are not used to hide taxable income.” The change is expected to raise ~$28B within a decade.

Read more →BloombergTax.com

The long wait for a killer app that drives mass adoption of digital assets may be over. Who knew it would be delivered in the form of a cartoon hamster who is the CEO of a crypto exchange?

That’s the premise behind Telegram’s tap-to-earn game Hamster Kombat, which launched in April and now has nearly 240MM Telegram users playing around the world. Telegram says it is the third-fastest app to ever reach 150MM users — rarefied territory for any app, no matter how long it takes to get there. Its YouTube channel rocketed to 32.6MM subscribers, prompting the company to apply for a Guinness World Record for speed. The game has 11.6MM followers on X and over 50MM subscribers to its Telegram channel.

While Hamster Kombat bills itself as a “crypto exchange CEO simulator” (as opposed to a clicker or tap-to-earn game), it does involve a lot of clicking. Players earn coins by tapping the hamster on the screen. They can boost their earnings by completing tasks like subscribing to Telegram channels or inviting friends to download the game.

While it’s clear that those tactics have fueled the game’s spread, the focus on recruitment has led some critics to compare it to multi-level marketing. That said, as Henry Nelson writes for CoinTelegraph, it’s hard to accuse the game’s creators of deceit since all they want is players’ time and engagement. There’s no money involved — at least for now.Some players are undoubtedly engaging in anticipation of an airdrop. The prospect of a token listing is dangled on the website, and users are encouraged to link their Telegram wallets to the game.

It will be interesting to see what will happen after the hype dies down, excitement about the airdrop subsides, and players run out of friends to invite. Similar games have burst on the scene and faded quickly, but none at this scale. No matter what happens, Hamster Kombat proves crypto games can reach far beyond hardcore crypto users and that Telegram is a force to be reckoned with when it comes to onboarding them.Read more →CoinTelegraph

BlackRock’s BUIDL Tokenization Fund Approaches $500MM — CryptoSlate

Bitcoin Miner Profits Rise in June as Market Adjusts to the Halving — CoinDesk

DigitalX Becomes Second BTC ETF Issuer on Main Australia Stock Market — Bloomberg ($)

VanEck, 21Shares Apply to Cboe for Solana ETF — CoinDesk

U.S. Court Rules Two Altcoins are Commodities — The Defiant

ETH ETF Issuers Submit Revised S-1 Filings to SEC — Blockworks

Sentient Raises $85MM to Open Source AI on its Blockchain — Cointelegraph

Report: Web3 Users Hit New High of 10MM in Q2 — Cointelegraph

Friend.Tech Sinks After Dropping Plans for Native Blockchain — The Defiant

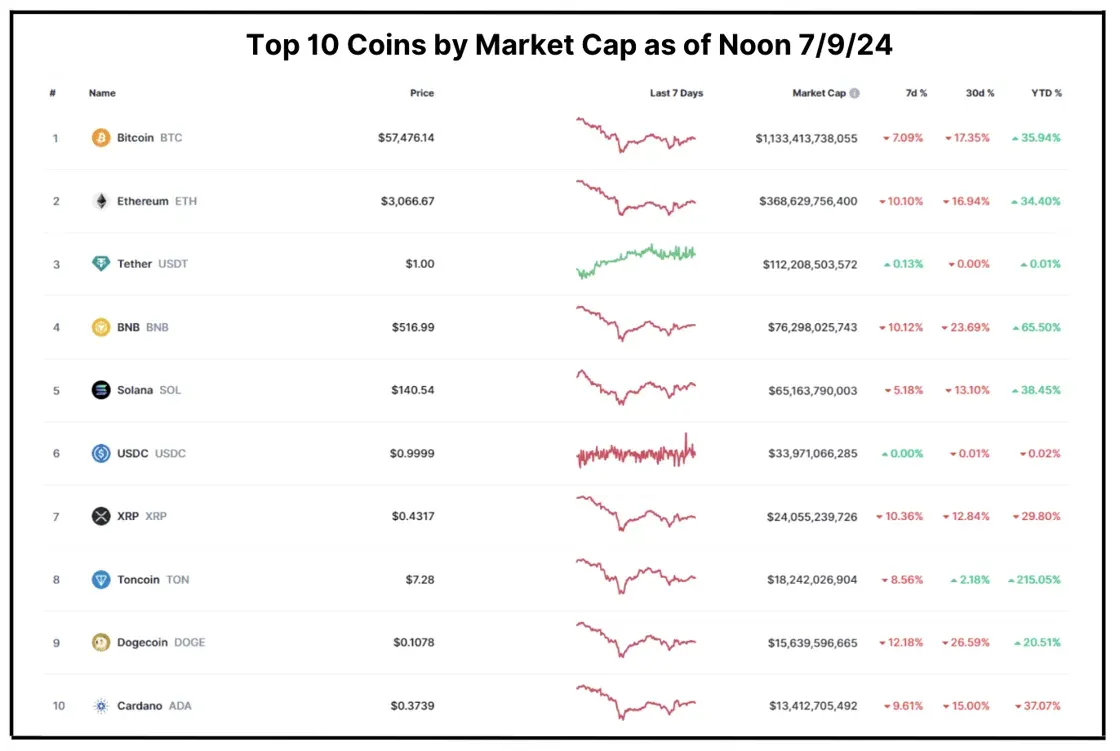

Total Market Cap: $2.11T — 7-day change as of Tuesday 7/9/24 12 PM EST: -7.9%

Chart and quotes via CoinMarketCap

Bitcoin (BTC, -7.1%) fell sharply over the U.S. holiday weekend in the United States, tumbling on Friday, July 5 to its lowest levels since February as concerns about selling pressure from the German government and Mt. Gox continued. Wintermute reports that the steep decline led to the most daily liquidations since FTX fell in 2022.

The German government has sold off about half of its 50K stash of seized BTC since June. On July 8 it sold $900MM worth and on July 9, it moved another 3,107 worth $178MM to various wallets and exchanges. Arkham Intelligence reports that Germany’s holdings are now down to 23,788 BTC, worth $1.3B.

Ethereum (ETH, -10.1%) sold off as the launch of ETH ETFs in the U.S., which many thought would come before the July 4 holiday, failed to materialize. Ethereum is down 16.9% over the past month, giving up the gains it accumulated following the approval of the 19b-4 forms for the ETH ETFs on May 23.

However, there is still room for optimism. Applicants filed their amended S-1s with the SEC ahead of a July 8 deadline. The Grayscale Ethereum Trust’s discount to NAV essentially disappeared for the first time in two years in a sign of both increased demand for ETH-related investment products from TradFi investors and confidence from opportunistic traders.

Top alt coins like BNB (BNB, -10.1%), Solana (SOL, -5.2%), Toncoin (TON, -8.6%), Cardano (ADA, -9.6%), and Avalanche (AVAX, -10.1%) all followed the top coins lower to varying degrees.

Open Source AI

noun

: Artificial intelligence source code, algorithms, pre-trained models, and datasets available for public use

/ Open source AI can be used by anyone for commercial or non-commercial purposes.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.