BitGo: Crypto Water Cooler — July 3

Inside Toncoin’s meteoric rise | Hong Kong lays out its vision for DeFi, Web3 | New research puts crypto money laundering in context

Inside Toncoin’s meteoric rise | Hong Kong lays out its vision for DeFi, Web3 | New research puts crypto money laundering in context

GM. It’s Wednesday, July 3.

It doesn’t generate much buzz on crypto Twitter, hasn’t got piles of VC cash, and isn’t listed on some major exchanges. But the Toncoin blockchain is achieving something many of its more ballyhooed competitors are still striving for: wide-scale adoption and product market fit.

The Toncoin ecosystem, which includes storage, services (including a domain name service), and a native token, TON, has racked up some impressive numbers this year. According to CryptoQuant, the network is processing $5B to $10B in daily transaction volume. By comparison, Bitcoin processes about $50B.

Its user base has grown from just under 3M a year ago to over 32M today; in June, it surpassed Ethereum in active addresses. TON is up 232.9% year to date, climbing to a market cap of $18.8B and joining the top 10 cryptos.The secret behind Toncoin’s success is its relationship with social messaging app Telegram — the same people founded both. As Pantera Capital, which recently made Toncoin its largest investment ever, explains, “99.999% of blockchain projects are a tech idea trying to create a community. That’s a hard road for most... Telegram is a community integrating blockchain technology.”

The community numbers 930M global users, and in many jurisdictions (the U.S. excluded) an in-app Toncoin wallet is automatically included. This distribution model puts Toncoin in a strong position, but it goes beyond that. Pantera writes that Telegram’s ethos around private, encrypted communications and free speech aligns with the core values of the crypto community.

Telegram creates other opportunities for Toncoin. Telegram channels generate 1T views per month, and earlier this year, Toncoin announced it will split ad revenue 50/50 with channel owners.Play-to-earn games have also contributed to Toncoin’s popularity. With a $1.4B market cap, Notcoin’s NOT is the biggest gaming token launched thus far in 2024.

Fast-growing Hamster Kombat has over 200M Telegram users playing. The game is so popular it has drawn the ire of the Iranian government, who believe it is meant to distract its people from its Presidential election.

Read more →Pantera Capital.

As part of Hong Kong’s push to become a leader in Web3 and digital assets, officials are publishing white papers almost as fast as people can read them. The latest two releases from the Hong Kong Institute for Monetary and Financial Research (HKIMR), an institution backed by the country’s central bank dropped in June.

In “Decentralised Finance: Current Landscape and Regulatory Developments”, HKIMR reports on interviews with key market participants about their usage of virtual assets, finding that most want to expand their activities. Liquid staking, flash loans, automated market makers, and TradFi activities like borrowing, lending, derivatives, insurance, and asset management are all under consideration — assuming regulations can be worked out.

Interviewees said TradFi-based regulations that use the “same activity, same risk, same regulation” principle would be appropriate. It seems likely that regulations would be quite strict; the country’s rigorous exchange licensing standards caused multiple applicants to leave the market. If that phenomenon were to repeat with DeFi, it could hinder infrastructure and workforce growth — two things the report cites as necessary for success.

In “The Metaverse: Opportunities and Challenges for the Financial Services Industry”, more than 90% of financial institutions surveyed demonstrated metaverse knowledge with 65% of them reporting involvement with it. However, the report defines “involvement” as discussion, planning, or implementation.

Perceived benefits include better connections with customers, more engaging branding, and unique service offerings. Major challenges include privacy concerns; limited functionality; limited interest and adoption; high costs for development and maintenance; challenges integrating with existing systems, and a lack of skilled talent.

Read more →Hong Kong Monetary Authority

It’s not just crypto that has a money laundering problem. The whole world does, as a sobering look at this crime-enabling crime from Invezz, a Bulgarian-based financial group makes clear. Money laundering is a global scourge, underpinning a wide range of violent activity from drug trafficking to human trafficking. In purely economic terms, it accounts for an average of 2–5% of global GDP, which would be between $2.2T to $5.5T in 2024.

Crypto will likely account for 1% or less of that; according to Chainalysis, crypto money laundering came in at around $2.2B in 2023. NFT laundering amounted to around $1.4MM in 2021, the last year for which data was available. Those amounts are dwarfed by the hundreds of billions of dollars that have been laundered through banks — collectively and individually.

And that’s just what’s been detected. About 90% of money laundering goes undetected, despite a profusion of rules and reporting requirements financial institutions must comply with. According to the Basel Institute of Governance, the risk of money laundering has changed little over the past five years. Banks wrongly fear that they can’t implement anti-money laundering and know your customer compliance measures with digital assets, but in fact digital trails are making it easier to spot bad actors.

One example: Earlier this spring a team from IBM, MIT, and Elliptic laid out a new method ($) of detecting money laundering on Bitcoin’s blockchain. This method, which uses Bitcoin’s enormous public repository of transactional data as a training set, could reduce the number of suspicious transactions investigators need to look at by an order of magnitude. The group has open-sourced their training data for use by all.

Read more →Invezz

Nubank to Bring Bitcoin Lightning Network to 100MM LATAM Customers —Cointelegraph

Sony to Restart Whalefin Exchange in Japan — CoinDesk

Bitget Launches $20MM TON Ecosystem Fund — CoinTelegraph

Circle Becomes First MiCA Compliant Stablecoin Issuer — CoinDesk

SEC Targets Liquid Staking With New Suit Against Consensys — CoinDesk

U.S. Federal Court Sentences Hydro Founders, Ruling That Its Crypto is a Security — The Defiant

Lombard Raises $16MM for Bitcoin Restaking — CoinDesk

Unstoppable Domains Tokenizes “.com” Domain Trading — The Defiant

New Solana Tool Plugs Its Functionality into Web2 Social Apps — CoinDesk

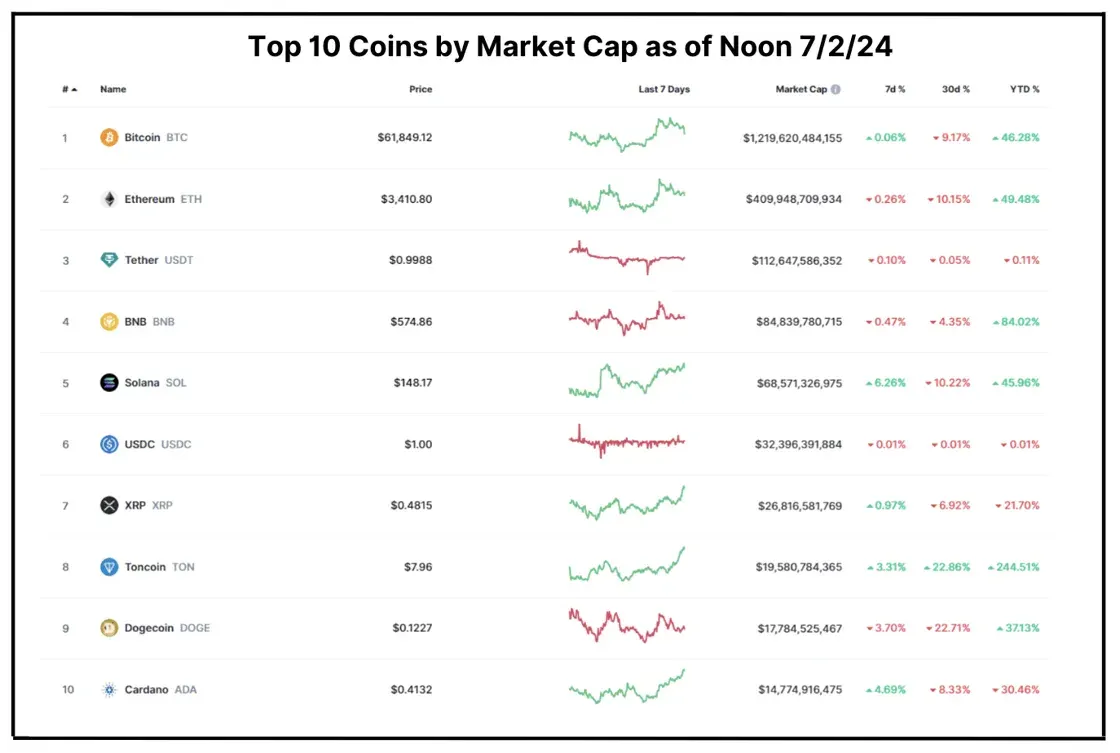

Total Market Cap: $2.29T — 7-day change as of Tuesday 7/2/24 12 PM EST: +0.0%

Chart and quotes via CoinMarketCap

The market ebbed and flowed this week, but finished at $2.29T — roughly in the same place it began. A holding pattern seems to have set in as traders anticipate U.S. approval of Ethereum (ETH, -0.3%) ETFs in early July.Bitcoin (BTC, +0.1%) put June’s losses in the rearview and held steady even as two whales — the German and U.S. governments — made big moves. The former has moved 3,000 BTC to centralized exchanges over the past two weeks and this week reportedly sold $54MM worth believed to have been seized from pirated movie website operator Movie2K. According to Arkham Intelligence, a wallet associated with the German government still holds $2.7B worth of BTC.

The U.S. government, whose reported holdings of $13.8B make it by far the largest nation-state owner of crypto, transferred $11.75MM worth of ETH to an unknown address on July 1, a week after moving 3,940 BTC worth $248MM to a centralized exchange. Much of this is believed to be from a stash seized from an Indian drug lord who agreed to forfeit the assets in a guilty plea earlier this year.

Bitcoin could face additional selling pressure as the long-defunct Mt. Gox exchange begins to repay over $9.4B worth of BTC to about 127K former customers who have been waiting for their funds for a decade. In May, Mt. Gox transferred 141,686 BTC worth over $9.6B to a new wallet as part of the process, which is expected to be completed in October of this year.

Bloomberg senior ETF analyst Eric Balchunas points out that despite Bitcoin’s June swoon, BTC ETFs saw net positive flows over the past day, week, and month, indicating that “Boomers are much better HODLers than some make them out to be.”Meanwhile, Solana (SOL, +6.3%) retook the $150 level as VanEck filed for a Solana ETF. Among other major layer-1s, Cardano (ADA, +4.7%) stood out with a gain as it released MiCA-compliant sustainability indicators.

Play to earn gamesnoun: Video games that offer rewards for completing in-game activities./ Play to earn game rewards can include crypto tokens and NFTs that can be converted to fiat.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.