BitGo: Crypto Water Cooler — June 19

Lido answers EigenLayer as restaking market grows | EU security experts weigh in on privacy vs law enforcement | Fan token fervor heats up

Lido answers EigenLayer as restaking market grows | EU security experts weigh in on privacy vs law enforcement | Fan token fervor heats up

GM. It’s Wednesday, June 19.

It’s hard to find a buzzier, faster growing protocol than EigenLayer, which CoinDesk recently hailed as “one of the biggest crypto success stories in recent memory.” It is one of many firms in the business of Ethereum staking, which has taken off since that protocol completed its transition to proof of stake in September of 2023. Now, EigenLayer is upending the staking ecosystem to the point where Lido, the long-time leader in the space, is having to respond.

EigenLayer enables restaking, an iteration of staking. In regular staking, users commit their holdings to validate transactions, thereby helping to secure the network in exchange for a reward. The cost of attacking a network is, in theory, equal to the value of tokens staked to secure it. With 33,066,282 ETH staked (about 27.6% of the ETH supply, currently worth about $116B) Ethereum is seen as a very secure network.

To become a validator and earn these rewards, however, requires 32ETH. Liquid staking pools such as Lido allow people to become validators on Ethereum (and other proof of stake networks) at a lower entry point. Lido also issues derivative tokens that stakers can use on other DeFi protocols.

Restaking takes this idea one step further, reusing tokens staked on Ethereum to secure additional blockchains. Users reap rewards from the other chains, which get to leverage Ethereum’s security.

Restaking is a growing business. Major players include EtherFi, which has over $6B in TVL; Renzo, $3.7B; and Puffer Finance, $1.7B. EigenLayer, which started 2024 with $1.3B in ETH deposited, has $18.5B today.

This has gotten the attention of incumbents, including Lido, the protocol behind Lido Staked Ethereum (stETH). With $32.7B in TVL, some within the industry have worried Lido’s dominance would threaten Ethereum’s decentralization. But its grip has loosened as EigenLayer gains market share. EigenLayer accepts deposits of stETH but places a cap on them, effectively causing its growth to come at Lido’s expense as users withdraw stETH to chase higher rewards on EigenLayer.

In response, Lido recently announced stETH-focused restaking vaults in collaboration with Symbiotic and Mellow Finance. Lido has also launched the Lido Alliance, a consortium of protocols and partners committed to protecting stETH’s position, and “reGOOSE,” described as “a multi-pronged strategy to help Lido to address the risks posed to it by restaking.”

Read more →CoinDesk

Advances in encryption technology provide new opportunities for bad actors and law enforcement alike, and striking the right balance of individual privacy with collective safety is one of the more difficult challenges in crypto. In its “First Report on Encryption” the EU Innovation Hub for Internal Security takes a deep dive into the topic from a legislative, technical, and developmental viewpoint. It also considers related judicial processes and court rulings.

The authors support both privacy and the use of lawful interventions while noting that, due to the rate of innovation, there is no easy and permanent fix. Ongoing collaboration among regulators, law enforcement, developers, academia, and crypto firms is critical to striking and maintaining the balance.

The use of now-decrypted communications as evidence is one area of relative clarity. Investigators have proven adept at exploiting blockchain transparency to deduce the identities of bad actors. In multiple cases, courts in France, Germany, Italy, and the Netherlands have granted law enforcement the right to use this evidence when collected in authorized ways.

Moreover, the Court of Justice of the European Union, in April 2024, ruled that prosecutors in member states have the right to request and use such communications from other jurisdictions — and EU member states must provide this information to other member states.

Getting that kind of evidence will become more challenging, however, if zero-knowledge proofs become more widely used and more sophisticated. The authors also cite concerns about layer 2 applications such as Mimblewimble that encrypt transactions such that only the opening and closing portions are visible, obscuring the dates and amounts. Advances in artificial intelligence and quantum computing could also provide new benefits and challenges for law enforcement.

Recommendations include the further development of legal frameworks to ensure lawful access to encrypted communications along with additional research and monitoring of emerging encryption technologies.

Read more →Eurojust

With the Euro 2024 and Copa América soccer championships and the Olympics, this summer is an epic season for sports fans. It’s also shaping up to be a great season for fan tokens — digital assets associated with a team, club, or player. Most of the major tokens are hosted on the Socios app on the Chiliz blockchain whose native coin, CHZ, has seen its TVL soar to nearly $900MM as fan activity has surged, up from $687MM at the year’s start.

To be sure, this is still a small corner of the cryptoverse. The current total market value of all fan tokens stands at around $380MM, and only four fan tokens out of the ninety-three listed on CoinGecko fall within the top thousand crypto coins by market cap. Three of these are related to soccer clubs: Paris Saint-Germain, Santos FC, and FC Barcelona. The fourth belongs to Karate Combat, a professional full contact karate league.

But, over the past year, the number of fan tokens has grown, perhaps because of the ease of launch on Solana and other blockchains. And, the tokens are finding some solid use cases. Fans enjoy perks such as early ticket access, raffle entries, merch discounts, and other loyalty rewards. One study shows that a relatively high percentage of token owners engage by voting on club-related decisions if the opportunity arises. Most of these are low stakes decisions, such as choosing a fight song, but the study results indicate interest in being involved in bigger decisions. Someday, fans buying tokens could even receive minority stakes in the teams themselves.

Tokens are tradeable, so there’s also a speculative use case. Users can trade tokens on Euro 2024 and Olympics matches using their crypto wallets. One study has already noted a familiar “buy the rumor, sell the news” pattern based on pre-competition hype. While the uptick has fan token advocates applauding, skeptics express caution over the tension between encouraging engagement and encouraging gambling.

Read more →Reuters

All Time Crypto Startup Funding Hits $100B — Bloomberg ($)

Deutsche Telekom Expands Crypto Activities, Adding BTC Mining — The Block

Itaú Unibanco, Brazil’s Largest Bank, Offers Crypto Trading to 60MM+ Customers —Bitcoin Magazine

Gensler Tells Congress ETH ETFs Could Be Approved This Summer — Bloomberg ($)

Uphold Delists 6 Stablecoins Ahead of MiCA Taking Effect — Cointelegraph

Taiwan Forms Crypto Industry Association Under Government Guidance — The Block

EU Chooses IOTA Foundation for Web3 Sandbox Initiative — crypto.news

ZK Cryptography Firm Nexus Labs Raises $25MM Series A — The Block

Ripple Launches Blockchain Fund in Japan and Korea — CNBC

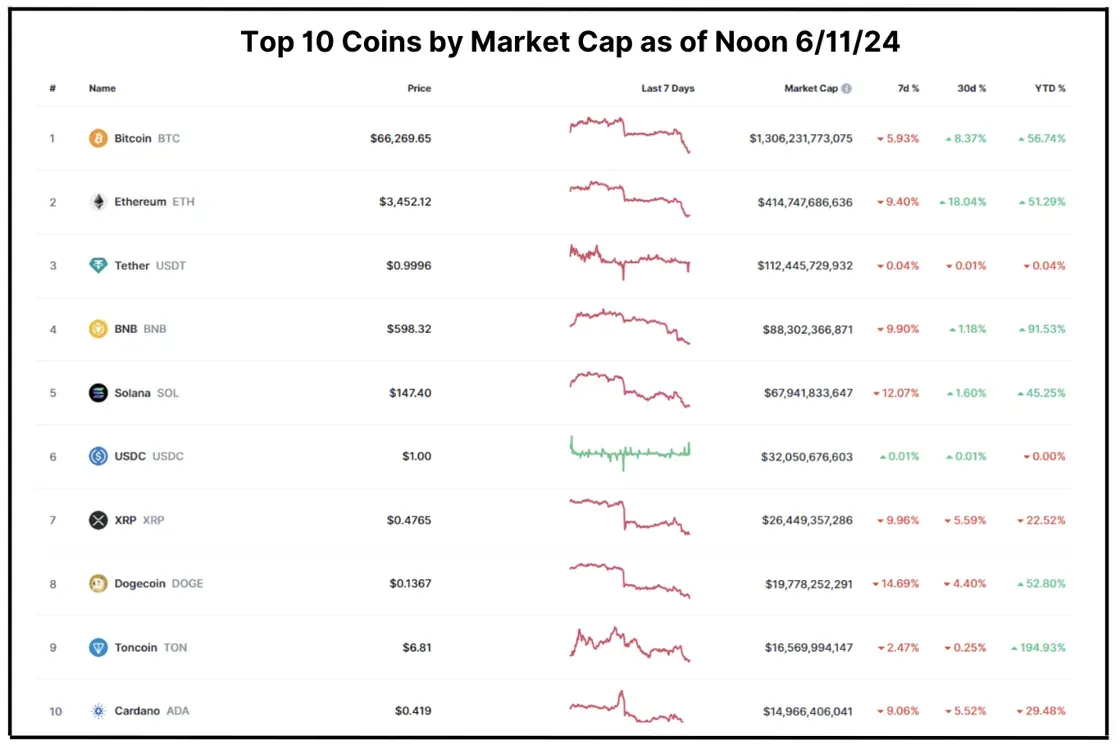

Total Market Cap: $2.33T — 7 day change as of Tuesday 6/18/24 12 PM EST: -2.9%

Chart and quotes via CoinMarketCap

The crypto market drifted lower for a second straight week, falling 2.9% to $2.33T. A stark warning from BlackRock that painted a bleak macroeconomic picture and posited higher interest rates as the new normal roiled traditional and crypto markets alike.

Macroeconomics aside, another factor that could be weighing on the price of Bitcoin (BTC, -2.4%): miners selling BTC to pay the bills. Crypto analytics firm CryptoQuant reports that miners are selling at the highest rate since the halving, which reduced their block rewards from 6.25 BTC to 3.125. They have collectively sold off $300MM of their BTC reserves in 2024. Marathon Digital, the industry’s largest player, has reportedly sold $92MM worth of BTC, or 8% of its supply, since the beginning of June.

The price of Ethereum (ETH, -0.7%) is down slightly, but there is plenty of reason for optimism as speculation is increasing that ETH ETFs could begin trading in the U.S. by the end of summer with Bloomberg senior ETF analyst Eric Balchunas predicting an early July launch.

Other major layer-1s such as Solana (SOL, -7.8%), Cardano (ADA, -10.6%), and Avalanche (AVAX, -15.9%) largely underperformed Bitcoin and Ethereum. Notable outliers included Uniswap (UNI, +4.6%), which saw accumulation by a whale, and Toncoin (TON, +2.8%) which is benefitting from the widespread popularity of the recently-launched Notcoin (-1.2%) and tap-to-earn game TapSwap. Notcoin has over 30MM users while TapSwap boasts over 49MM.

In airdrop news, ZKsync completed the highly-anticipated airdrop of its token (ZK, -10.3%), which gave the Ethereum layer-2’s token an initial market cap of $800MM. However, according to data from Nansen, 71% of the top 10,000 holders have now sold off their tokens.

Quantum Computing

noun

: A type of computing that uses the principles of quantum mechanics

/ Quantum computing cannot currently perform any useful task faster, cheaper, or more efficiently than classical computing.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.