BitGo: Crypto Water Cooler — June 26

Solana pulls up next to Ethereum in blockchain race | MiCA remaking the EU stablecoin market | The latest attempts to make BTC greener

Solana pulls up next to Ethereum in blockchain race | MiCA remaking the EU stablecoin market | The latest attempts to make BTC greener

GM. It’s Wednesday, June 26.

Solana’s breakout from its cohort of half a dozen or so “Ethereum killers” is one of the biggest crypto stories of 2024. But, while it has bested Ethereum in some areas, it’s emerging as less killer and more alternative. “The Mac OS of Blockchains” is how Pantera Capital put it in a recent think piece, drawing a comparison between Solana’s monolithic architecture — which is similar to Apple’s — and Ethereum’s modular approach.

That monolithic architecture allows it to innovate faster and optimize every element of its tech stack — including its Saga mobile phone — in Apple-like fashion, making it a favorite among the developers who are the main customers of blockchains. Like Apple, it’s also winning hearts and minds with some participants saying that Solana is now where the culture is. Its Phantom Wallet was the #1 finance app in Apple’s app store for much of May and early June, briefly reigning as the top overall app in any category.

To be sure, a lot of the activity is around meme coin development and trading fueled by Solana’s lower costs and ease of use. That’s been a double-edged sword. Meme coin trading has contributed to growth in users and usage. In June, Solana’s unique active addresses hit 1.34M while ETH saw 400k-700k daily active users. In May, Solana’s share of decentralized exchange (DEX) trading volume was 24%; ETH had just over 30%.

However, it has also generated bad press over pump and dump schemes and parasitic market making, which has diverted attention from serious projects, including collectibles platform DRiP; Hivemapper, a decentralized mapping network; Phoenix, a DEX built on a central limit order book, and lending platform marginfi.

Despite its growth, the price of Solana is down nearly 25% over the past 30 days, and the SOL/ETH price ratio recently plummeted 35%, to its lowest level since March, indicating that the tide may be turning. Excitement about the increasing likelihood of approval for ETH ETFs is working in ETH’s favor while growing weariness of the Player vs. Player (PVP) nature of the meme coin market may be hurting Solana.

But blockchain development is not a PVP, zero sum game. Pantera writes, “historically, developer-facing technologies have converged around a small number of dominant players... We see this in operating systems (Windows, macOS, Linux), gaming consoles (Sony, Microsoft, Nintendo), and mobile platforms (Apple, Android).” Its recent performance has put Solana in the running to be one of that number.

Read more →Pantera Capital

The first phase of MiCA regulations will take effect on June 30 and continue to roll out through December. But the new rules are already remaking the EU stablecoin market. Multiple exchanges — including Uphold and Binance — are delisting stablecoins that won’t meet the new requirements; other exchanges are considering similar actions. OKX delisted stablecoins in March.

The new rules are tough in part to prevent Terra-style meltdowns (algorithmic stablecoins are banned) but also to protect the Euro. Requirements for fiat-backed stablecoins include electronic money licensing and supervision by the European Banking Authority. Trading will be maxed at 200MM € daily on a quarterly average, which is significantly lower than much of today’s stablecoin volumes — particularly those with U.S. dollar pegs. Issuers that operate outside the EU but provide services to residents must comply with regulations; so, non-EU issuers may need to make significant changes in how they operate if they want to participate in the EU market.

Requirements for a liquid reserve with a 1:1 ratio in cash held in custody by a third party have been particularly tough to swallow. Issuers with 10MM-plus users or €5B or more in reserves must hold at least 60% of reserves in banks with no more than 10% at any one bank. Many of the established issuers hold their reserves in U.S. Treasury bills, so these requirements could hurt well-established stablecoins such as USDT, which is currently the main method that European exchange customers use to transition from fiat to crypto. Dollar-backed stablecoins overall see average weekly trading volumes of $270MM.

Euro-backed stablecoins could benefit from an exodus of dollar-backed competitors. French financial services giant Société Générale proactively launched a Euro-pegged stablecoin (EURCV) in December 2023, becoming the first fully regulated bank subsidiary to do so. And trading in Euro-pegged coins has grown consistently in volume with the weekly trading volume of five of them exceeding $40MM since March, which is the longest run to date for this level of trading volume. Low volume local e-money tokens, which are only required to have a 30% bank reserve, could also benefit.

Read more →en.cryptonomist.ch

Bitcoin mining famously consumes significant amounts of energy, and public and private entities continue to look for ways to make it greener. New efforts include investments in green energy and using flared gas — a byproduct of natural gas mining that would otherwise go to waste.

Late last month, Bitcoin mining company Marathon Digital announced it will partner with Kenya’s Ministry of Energy and Petroleum to help develop the country’s energy infrastructure. More than 80% of Kenya’’s electricity is already generated through renewable sources. In addition to providing technical knowledge, Marathon will contribute $80MM+ toward building green data centers.

In March, Houston-based Giga Energy announced a partnership with IT services company Exa Tech and oil and gas company Phoenix Global Resources to mine Bitcoin in Mendoza, Argentina — home to the world’s second biggest shale gas reserve. Giga’s goal is to turn flared natural gas into electricity to power Bitcoin mines. The company says the system reduces CO2-equivalent emissions by 63% when compared to burning (“flaring”) the unused gas and can also turn would-be wasted energy into a valuable asset for its producers.

The Argentinean project follows initiatives across the United States and in Shanghai. Although not intended to be profitable out of the gate, the partnership generated $10MM+ in quarter one revenue as $200,000+ of Bitcoin was mined. Excess power can go to the Argentinian grid.

Also in March, researchers at Cornell University authored a paper proposing to use Bitcoin profits to drive development of a green hydrogen infrastructure that would in turn power Bitcoin. Investigators at The Verge who analyzed the plan say it has many pitfalls, including a lack of incentives for miners to invest profits this way.

Read more →Verge

Hashdex Files With SEC for First-Ever Combined BTC/ETH ETF — Trading View

First BTC ETF Lists on Australia’s Largest Stock Exchange — Bloomberg ($)

Survey: 54% of Japanese Institutional Investors Plan to Invest in Crypto — Cointelegraph

SEC Drops Ripple Probe — But Not Penalties — Cointelegraph

VanEck Files Form 8-A for Spot ETH ETF — CoinGape

UK FCA Arrests Two Londoners for Running $1.2B Unlicensed Exchange — crypto.news

Hong Kong Parliament Sets Up Web3 and Digital Assets Subcommittee — The Block

Colosseum Raises $60MM to Invest in Solana Hackathon Winners — crypto.news

Web3 Bug Bounty Platform Immunefi Tops $100MM in Payouts to Ethical Hackers — The Block

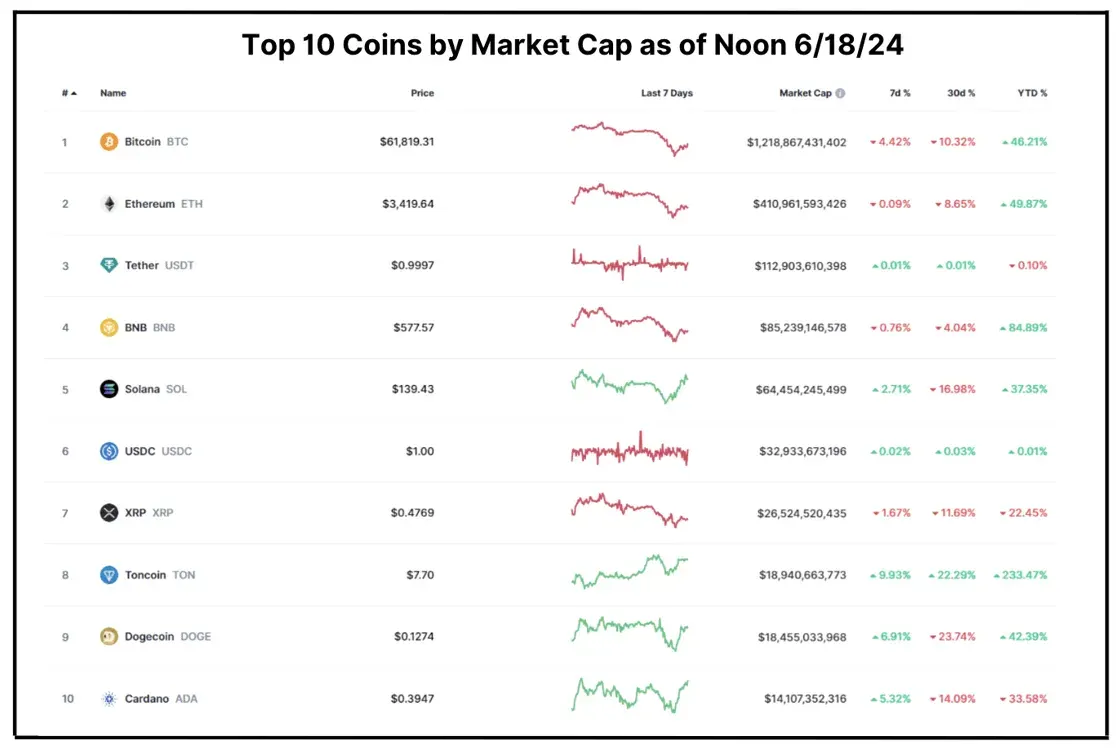

Total Market Cap: $2.29T — 7 day change as of Tuesday 6/25/24 12 PM EST: -1.7%

Chart and quotes via CoinMarketCap

The crypto market trended lower for a third consecutive week, falling 1.7% to $2.29T as Bitcoin (BTC, -4.4%) briefly fell below $60,000 on Monday before rallying back above $61,800 at the time of writing.

MicroStrategy took advantage of the dip to make its third-largest ever purchase of BTC, issuing convertible senior notes to buy 11,931 BTC for $786MM and bringing its total stash to 226,331 BTC.

Ethereum (ETH, -0.1%) was quiet as the market awaits potential news of a decision on approval for ETH ETFs, which Bloomberg ETF analysts predict will come by July 2.

Solana (SOL, +2.7%) fell sharply over the weekend, in part on so-far unsubstantiated claims by a popular crypto Twitter user that Solana is “under investigation,” before rebounding strongly on Tuesday. In other alt coin news, Bloomberg reports ($) that selling by early VC investors and founders via token unlocks could be a headwind for alt coins like Avalanche (AVAX, -1.8%). Out of 138 tokens tracked by researcher TokenUnlocks, 120 have a token unlock coming up this year with a combined market value of $58B.

Toncoin (TON, +9.9%) was again a notable outlier, adding to its impressive 233.5% YTD gain. One major catalyst was Binance introducing support for Tether (USDT, +0.0%) on Toncoin. Another is the rising popularity of “tap to earn” games like Notcoin (-2.2%) and Hamster Kombat on the platform.

Modular Blockchain

noun

: A blockchain that delegates one or more function to a separate chain

/ Modular blockchains are comprised of multiple components with each specialized and optimized for a particular process.

About BitGo

BitGo provides the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending, and core infrastructure to investors and builders alike.

Founded in 2013 — the early days of crypto — BitGo pioneered the multi-signature wallet and later built TSS to improve upon other companies’ MPC offerings. Between multi-sig and TSS, BitGo offers the safest technology on the market and safeguards over 600 tokens across a wide variety of blockchains.

Over the years, BitGo has expanded from offering wallets into providing a full-suite solution that lets clients hold assets safely and then put them to work.

BitGo launched BitGo Trust Company in 2018, providing fully regulated, qualified cold storage to complement BitGo Inc’s original hot wallet solution. In 2020, BitGo launched BitGo Prime, which allows its clients to trade, borrow, and lend. Moreover, BitGo also provides access to DeFi, staking, NFT wallets, and beyond, and serves as the world’s sole custodian for WBTC, or wrapped Bitcoin.

Today, BitGo is the leader in digital asset security, custody, and liquidity, providing the operational backbone for more than 700 institutional clients in over 50 countries — a list that includes many regulated entities and the world’s top cryptocurrency exchanges and platforms. BitGo also processes approximately 20% of all global Bitcoin transactions by value.

For more information, please visit www.bitgo.com.

©2024 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.