TL;DR — cold wallets store your crypto keys offline for maximum security, while hot wallets stay connected to the internet for ease of use.

Hackers have stolen more than $7 billion worth of cryptocurrency since 2022, according to a recent TRM Labs report. Nearly 70% of those losses stem from infrastructure attacks, in which private key or seed phrases are compromised. If you hold considerable assets, deciding between a cold wallet vs. hot wallet is a crucial security choice.

-

Wallets store private keys, which allow you to access, send, and receive crypto. These keys can be managed via software that is always online (hot) or hardware that isn’t (cold).

-

If you own assets on a platform like Coinbase, it manages your wallet for you. People with considerable holdings sometimes prefer to manage wallets themselves.

-

Hot wallets are more convenient to trade with but come with cybersecurity risks. Cold wallets are safe from online threats but can be physically lost or stolen.

At a Glance: What Is a Wallet?

Cryptocurrency isn’t actually stored on exchanges or in wallets. It lives on the blockchain.

A wallet holds the private keys, which prove ownership of the coins. Think of it like a keyring: it doesn’t store the coins; it holds the keys that unlock them on the blockchain. There are important differences between hot vs. cold wallets. But whether you use a piece of hardware, an app, or a simple piece of paper, you can’t control your crypto without the keys.

Hot Wallet vs. Cold Wallet

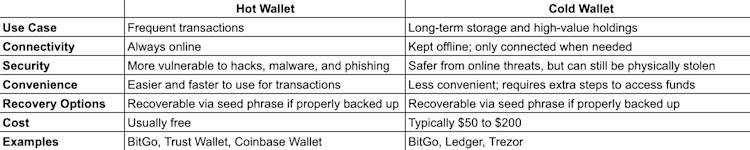

There are two types of crypto wallets: hot and cold. The key difference is internet connectivity.

-

Hot wallets stay connected to the internet, making transactions fast but exposing assets to cyber threats.

-

Cold wallets are kept offline, providing stronger security but requiring extra steps to access funds.

Each type has strengths and weaknesses, and the right choice depends on how you want to manage your assets.

Types of Cold Wallets

Cold wallets come in a variety of shapes and forms.

-

Hardware wallets: Some wallets resemble flash drives (Ledger), while others look like car key fobs (Trezor) or even credit cards (Tangem). Each device will work a little differently, but in general, you’ll connect them to the internet only when it’s time to make a trade.

-

Air-gapped devices: Some cold wallets never connect to the internet at all. You initiate transactions online, export the details to the cold wallet with a QR code or flash drive, and return the now-verified transaction with the same QR code or flash drive.

-

Paper “wallets”: These are low tech and low security. It’s not common, but you could theoretically write your private keys on a piece of paper.

Pros and Cons of Cold Wallets

Cold wallets require extra steps to access funds, cost money, and can be physically lost or stolen. However, offline storage protects against hackers and the risk of hot wallet applications failing or being hacked. They’re widely considered safer — but less convenient — than hot wallets.

If you hold considerable assets, BitGo’s custodial wallets add another layer of protection to cold wallet security in insured, qualified custody. We generally maintain keys in cold storage on your behalf. When you request to move funds, our team will guide you through security protocols. Subject to those checks and applicable policies, your transfer request will be approved.

Types of Hot Wallets

Nearly all hot wallets are free to download. Some are coded as browser extensions, while others are mobile- or desktop-friendly apps. The key to understanding the different types is knowing they’re designed with particular currencies, ecosystems, or trading platforms in mind.

For instance:

-

MetaMask is designed for the Ethereum ecosystem of coins.

-

Phantom Wallet is designed for the Solana blockchain.

Not all hot wallets offer the same level of privacy, security, or developer expertise. Before using one, research the team behind it, their track record, and their commitment to protecting users.

Pros and Cons of Hot Wallets

Hot wallets provide fast and convenient access to crypto, making them ideal for frequent trading. They’re usually free to download and require no extra hardware.

However, their always-online status carries security risks. Weak passwords or successful phishing attacks can lead to stolen cryptocurrency, making hot wallets less suitable for long-term storage of significant funds.

If you’re a trader, BitGo offers hot wallet convenience with institutional-grade security. Our multi-signature system lets you maintain liquidity without sacrificing security. Simply start a trade with your self-managed key, and if it matches your pre-set policies, we’ll countersign and authorize the transfer.

Comparing Cold vs. Hot Crypto Wallets

When deciding between a cold wallet vs. a hot wallet, it comes down to your risk tolerance, trading frequency, and asset size. What do you prioritize most?

-

If security is your top priority, a cold wallet is the safer option.

-

If convenience matters most, a hot wallet offers easier access.

-

Some investors use a combination of both, keeping a portion of funds in a hot wallet for regular use and the rest in a cold wallet for safekeeping.

BitGo is an industry-leading choice for insured, regulated, and qualified custody of your assets. BitGo offers self-custody hot wallets, qualified custody cold storage, and other advanced security solutions designed to help safeguard your digital assets. Read our custody guide to learn more about the relationship between wallets and custodianship.

FAQ

Is a cold wallet safer than a hot wallet for storing cryptocurrencies?

A cold wallet offers stronger protection against cybersecurity threats than a hot wallet. Since hackers can’t remotely access a cold wallet, it provides a higher level of security for long-term storage. However, cold wallets can still be physically lost, stolen, or damaged, so it’s important to have backup measures in place.

How do I choose between a cold wallet vs. hot wallet for my needs?

This depends on your security needs, usage frequency, and investment strategy. Cold wallets maximize security and are ideal for buy-and-hold strategies and large amounts of assets. Hot wallets are more convenient for frequent transactions but come with higher cybersecurity risks.

Can I use both a cold wallet and a hot wallet simultaneously?

Yes, many crypto users combine hot and cold wallets to balance security and convenience. A common approach is to store the majority of assets in a cold wallet for long-term security and keep a smaller amount in a hot wallet for quick trades, purchases, or use with decentralized applications (dApps).

What are some common types of cold and hot wallets available?

Popular cold wallet options include hardware wallets like Ledger, Trezor, or Tangem, or custodial wallets like BitGo. For hot wallets, consider options designed with your preferred currency or trading platform in mind. For example, MetaMask, Phantom Wallet, or Coinbase Wallet.

Table of Contents

- At a Glance: What Is a Wallet?

- Hot Wallet vs. Cold Wallet

- Types of Cold Wallets

- Pros and Cons of Cold Wallets

- Types of Hot Wallets

- Pros and Cons of Hot Wallets

- Comparing Cold vs. Hot Crypto Wallets

- FAQ

- Is a cold wallet safer than a hot wallet for storing cryptocurrencies?

- How do I choose between a cold wallet vs. hot wallet for my needs?

- Can I use both a cold wallet and a hot wallet simultaneously?

- What are some common types of cold and hot wallets available?

The latest

All NewsAbout BitGo

BitGo is the leading infrastructure provider of digital asset solutions, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have focused on enabling our clients to securely navigate the digital asset space. With a large global presence through multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, as well as millions of retail investors worldwide. As the operational backbone of the digital economy, BitGo handles a significant portion of Bitcoin network transactions and is the largest independent digital asset custodian, and staking provider, in the world. For more information, visit www.bitgo.com.

©2025 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.