Believe it or not, the Ethereum Merge recently passed the one year anniversary mark. Last year, the Merge ushered in the dawn of a new era not just for Ethereum network, but for the crypto staking landscape as a whole — the world’s second-largest digital asset by market cap seamlessly transformed from the second-largest proof-of-work asset into, by far, the largest proof of stake digital asset by market value (worth $200 billion at time of writing). The transition to Proof of Stake not only significantly reduced Ethereum’s electricity consumption by 99.99%, it paved the way for more Ethereum users to participate in the network and to earn rewards for validating transactions and securing the network by staking their holdings.

Staking has grown into a sizable part of the market — the recent Q3 2023 State of Staking report from Kraken finds that the total value of staked assets grew to $71 billion during the third quarter, a 5% increase from the previous quarter. Proof-of-stake assets now combine to account for 23% of the total crypto market cap. Bitcoin, which is a proof-of-work asset, still makes up the lion’s share of the crypto market’s value (Bitcoin dominance currently stands at 50.6%).

Staking is now a massive ecosystem, with the report showing that the top 35 proof-of-stake cryptocurrencies combine for a market cap of $280 billion. Ethereum accounts for about 80% of this $280 billion total. Read on for more on why staking continues to become an increasingly important part of the Ethereum network and an attractive option for Ethereum holders.

Shapella Upgrade — Unlocking Staking’s Potential

The Merge changed Ethereum into a proof of stake asset overnight, but staking on Ethereum didn’t fully take off until the Shapella upgrade about 7 months later, in April 2023. The implementation of Shapella allowed stakers to withdraw their holdings for the first time since December 2020. This gave early stakers the ability to unlock their holdings and withdraw the staking rewards they had built up, and removed uncertainty on how withdrawals would work going forward. This was of particular concern to institutional investors, who prioritize liquidity, especially in a market where prices can be volatile.

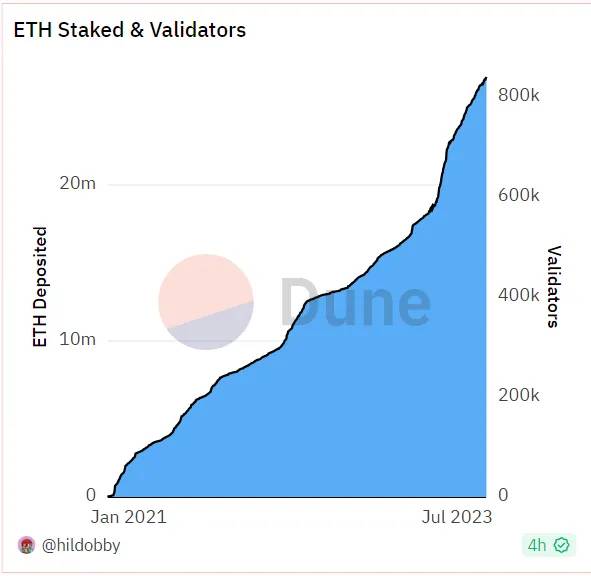

The benefit of this upgrade is easy to see, as the amount of Ethereum staked continues to increase over time.

In the run up to Shapella, some observers believed that there would be a large outflow from staking and a sell-off of Ethereum, reasoning that holders who had been locked in for almost two years would rush to sell.

However, that’s not how things transpired: since the upgrade in April there has actually been a significant net inflow of over nearly 7.7 million ETH into staking. This large influx shows the powerful effect that removing the uncertainty surrounding the time frame for making withdrawals has had on staking demand.

Additionally, the percentage of the total supply of ETH that is staked is now an 8.1% increase from before Shapella. Some Ethereum observers believe that this percentage will continue to increase going forward, perhaps reaching 50% as soon as May of 2024.

Source: Dune Analytics @hildobby

Entry and Exit Queues: Significantly Shorter

There were initially long queues to enter staking positions, as stakers jostled for position before the Shapella upgrade. These queues worsened when Kraken ended its staking operations as part of a settlement with the Securities and Exchange Commission; Kraken stakers migrated to other services, creating a bottleneck.

As things have normalized, the time of the exit queue has decreased from days to just 51 minutes, meaning that stakers now have the freedom to exit relatively quickly if needed. At time of writing, there are just 38 validators in the exit queue.

Simultaneously, the entry queue for staking has also decreased since Shapella to more normalized levels from a high of 46 days. The entry queue is now under five days, with nearly 10,600 validators waiting to begin staking, illustrating a healthy demand for staking.

A remaining challenge

One challenge resulting from the growing interest in staking is that there are now over 850,000 validators. While this is good for decentralization, the number of machines and their far-flung geographic dispersion leads to strain on the Ethereum network. This can result in greater latency, disruptions, and a longer wait to reach consensus.

To an extent, this is a good problem to have as it means that interest in Ethereum and staking is increasing. However, to ensure the best possible user experience and to make sure Ethereum remains competitive in a crowded field of alternative blockchains, this is a challenge that Ethereum developers are working diligently to solve. A potential solution being tabled is increasing the maximum cap on the number of ETH per validator to 2,048 (up from 32). If implemented, this change would significantly reduce the number of machines currently operating on the network, reducing latency and improving settlement times.

Ethereum Rewards Weathering the Storm in a Turbulent Market

According to Ethereum.org, the current APR for staking is 3.8%. The rate has declined marginally as the number of validators increases, but with MEV Boost (the middleware validators use to increase staking rewards by selling blockspace to an open market of block-builders) enabled, the returns are higher, ranging from 4.2% and 5.6% over the past six months. Over 90% of nodes have MEV Boost enabled. MEV Boost is also beneficial to users because it creates competition among block builders, allowing validators to sell their blockspace to the highest bidder. Furthermore, MEV Boost democratizes the staking process by allowing smaller validators to participate, increasing Ethereum’s censorship-resistance.

Upcoming upgrades that will bring lower gas fees, greater speed, and account abstraction to Ethereum are on the horizon, further increasing its appeal to users and investors.

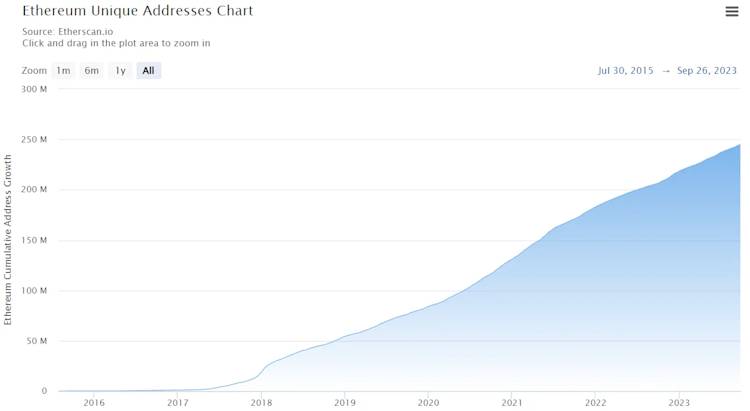

Network participation continues to climb since the Merge. Before the Merge, there were approximately 205 million unique Ethereum addresses. This number has increased to over 245 million today.

Source: Etherscan.io

Rising Tide of Ethereum ETFs

Another recent development that has emerged since the Merge is the advent of Ethereum ETFs. This October, nine Ethereum futures ETFs began trading in the U.S. for the first time. This is a significant milestone for Ethereum and the digital asset space as a whole as it gives investors the ability to gain exposure to Ethereum through their brokerage accounts for the first time.

Additionally, a large number of applications for spot Ethereum ETFs are awaiting a decision on approval from the SEC. In contrast to an Ethereum futures ETF, a spot Ethereum ETF would directly buy and hold Ethereum rather than futures contracts.

The new availability of Ethereum ETFs is a significant milestone for the Ethereum network, and for the broader digital asset industry, as they empower individual investors to gain exposure to Ethereum without the need to directly hold it themselves. ETFs have surged in popularity in recent years and grew to nearly $6.5 trillion in assets under management at the end of 2022, indicating the immense scope of the market that Ethereum is now becoming a part of.

This potentially unlocks access to Ethereum to more potential investors than ever before. For example, individuals who believe in the future of Ethereum but don’t feel comfortable or confident enough to buy and store it themselves can now gain long-term exposure to it through an ETF.

Ethereum ETFs also enable investors to gain exposure through their retirement accounts, potentially unlocking a vast new pool of investment capital for Ethereum.

Ethereum ETFs from globally-recognized TradFi managers with significant trust and brand equity can also spur mainstream adoption and acceptance of Ethereum.

With BitGo you can custody Ethereum with the industry’s leading regulated and audited security technology, and our platform empowers you to also seamlessly earn ETH staking rewards through our user-friendly interface. All staking rewards are determined by the Ethereum Network and can be verified on the blockchain, you are in direct control of your staking, we do not pool assets or stake without your consent.

We have recently released a new staking dashboard to enhance our customer’s staking experience. To learn more please reach out to our team.

Table of Contents

The latest

All NewsAbout BitGo

BitGo is the leading infrastructure provider of digital asset solutions, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have focused on enabling our clients to securely navigate the digital asset space. With a large global presence through multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, as well as millions of retail investors worldwide. As the operational backbone of the digital economy, BitGo handles a significant portion of Bitcoin network transactions and is the largest independent digital asset custodian, and staking provider, in the world. For more information, visit www.bitgo.com.

©2025 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.