The crypto regulatory landscape is experiencing significant changes at a remarkable pace, providing unique opportunities and challenges for traditional financial institutions. Despite market volatility, institutional adoption of crypto continues to steadily increase with major banks, asset managers and financial services firms beginning to expand their crypto offerings to meet growing demand.

Against this backdrop of industry momentum, the regulatory landscape has been undergoing significant transformation as well. Staff Accounting Bulletin (SAB) 121, issued in March 2022 by the U.S. Securities and Exchange Commission (SEC), established account guidelines which created barriers for many institutions looking to enter the space. However a pivotal development in December 2024, rescinded these requirements with the introduction of SAB 122, providing banks and broker-dealers with a clearer pathway to develop compliant crypto offerings without the accounting constraints.

Understanding SAB 121

SAB 121 was introduced as a response to the increasing number of institutions beginning to custody crypto assets. This imposed substantial accounting requirements on entities looking to safeguard crypto assets due to the perceived technological, legal and regulatory risks associated with holding these assets. The SEC’s guidance included requiring institutions to:

-

Recognize a liability on balance sheets equal to the fair value of the crypto assets being held

-

Recognize a corresponding asset reflecting the obligation to the asset holders

-

Provide fair value measurement of these assets and liabilities in each reporting period

-

Provide extensive risk disclosures related to crypto asset safeguarding

By requiring firms to hold crypto assets on their balance sheets, SAB 121 created capital inefficiencies that made institutional crypto services prohibitive. However, with the introduction of SAB 122, the regulatory landscape is shifting, creating new opportunities for traditional financial institutions to enter the crypto space.

What Changed with SAB 122?

SAB 122, released in December 2024, effectively rescinded SAB 121 and its requirements, marking a significant, more pragmatic shift in regulatory approach. While SAB 122 doesn’t eliminate all regulatory challenges, it reduces the capital constraints that banks previously faced, making it feasible to offer digital asset services without major balance sheet repercussions.

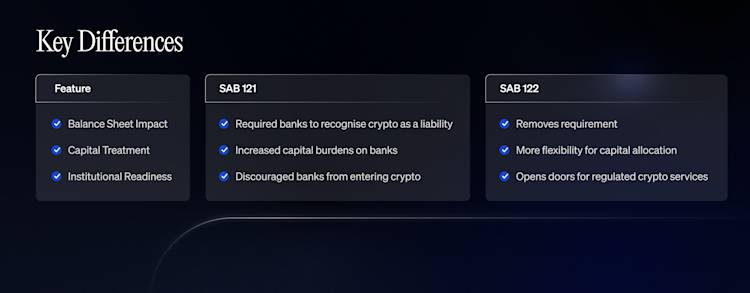

Key Differences:

What This Means for Banks and Broker-Dealers

Banks and broker-dealers have long been cautious about crypto due to the regulatory uncertainty and balance sheet concerns. With SAB 122, traditional financial institutions can now:

-

Face lower barrier to entry for crypto services

-

Offer crypto custody services without excessive balance sheet/capital requirements

-

Expand their services to institutional clients seeking regulated digital asset solutions

As traditional finance and crypto continue to converge, now is the time for banks and broker-dealers to explore their digital asset strategies. While this regulatory shift makes crypto more accessible to these traditional financial institutions, it is still important for institutions to note that crypto custody and services require specialized expertise and trusted infrastructure.

How BitGo Can Help

BitGo stands as the industry’s leading independent qualified custodian, purpose-built for institutional clients. For over a decade, we’ve been at the forefront of building secure, compliant infrastructure for crypto. Our longevity in this space isn’t just a testament to our resilience, it’s evidence of our ongoing commitment to bringing institutional-grade security and regulatory compliance to the industry. BitGo was designed from the ground up to meet the rigorous standards that banks and broker-dealers require. Our custody platform incorporates:

-

Bank-grade security protocols with multi-signature technology

-

SOC 1 Type 2 and SOC 2 Types 2 certifications

-

$250M in insurance coverage(1)

-

BSA/AML compliance frameworks

-

Comprehensive procedures and controls aligned with traditional financial controls

-

Robust API infrastructure that integrates with existing banking systems

BitGo is uniquely positioned at the intersection of traditional finance and technology. Our leadership team brings decades of experience from both Wall Street and Silicon Valley. This dual expertise means we understand both the regulatory realities that banks face and the technological innovations that make crypto powerful.

Let’s build the future together. Connect with us to learn more.

Table of Contents

The latest

All NewsAbout BitGo

BitGo is the leading infrastructure provider of digital asset solutions, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have focused on enabling our clients to securely navigate the digital asset space. With a large global presence through multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, as well as millions of retail investors worldwide. As the operational backbone of the digital economy, BitGo handles a significant portion of Bitcoin network transactions and is the largest independent digital asset custodian, and staking provider, in the world. For more information, visit www.bitgo.com.

©2025 BitGo Inc. (collectively with its affiliates and subsidiaries, “BitGo”). All rights reserved. BitGo Trust Company, Inc., BitGo Inc., and BitGo Prime LLC are separately operated, wholly-owned subsidiaries of BitGo Holdings, Inc., a Delaware corporation headquartered in Palo Alto, CA. No legal, tax, investment, or other advice is provided by any BitGo entity. Please consult your legal/tax/investment professional for questions about your specific circumstances. Digital asset holdings involve a high degree of risk, and can fluctuate greatly on any given day. Accordingly, your digital asset holdings may be subject to large swings in value and may even become worthless. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. BitGo is not directing this information to any person in any jurisdiction where the publication or availability of the information is prohibited, by reason of that person’s citizenship, residence or otherwise.